The mammoth task of merging Ethereum’s mainnet and Beacon Chain is finally complete, but what are the risks?

What are the risks and flaws of the Ethereum merge?

One of the foremost concerns regarding the Merge is that of centralization. Another potential concern is the risk of scams, as the general public may not be aware of how the Merge works.

A fundamental flaw in the Merge is that it will likely increase the concentration of power within the network. The more valuable a staker’s position is, the more they will be rewarded for validating blocks. This could lead to a situation where a small number of wealthy individuals or groups control the majority of the stake and have disproportionate influence over the network.

Five major organizations control 64% of the network’s stake. In the event of a contentious fork, these organizations could collude to choose which chain to support, potentially censoring transactions or double-spending funds. Already, critics are debating whether the Merge is a “rich get richer” scheme that will entrench the power of current stakeholders.

Since staking will be required to earn interest on one’s ETH holdings, those who cannot afford to stake may be priced out of the market. This could lead to increased centralization as only those with large amounts of money would be able to participate in staking.

It’s also not uncommon for scammers to take advantage of big transitions such as The Merge, pretending that users need to do something (usually involving giving up tokens) to upgrade. Wallet upgrades are also a potential source of scams, as users may be tricked into downloading malicious software masquerading as an official update.

Lastly, miners who have been mining in Ethereum’s mainnet for years may yet decide to continue on Ethereum’s old chain. After all, many of these miners have likely incurred huge electricity and hardware expenses and may feel that they have more to gain by sticking with the tried-and-true mainnet.

This could lead to a split in the community, with two competing versions of Ethereum running concurrently. While this scenario is unlikely, it’s still a possibility that investors should be aware of.

Will the Merge change the Ethereum ecosystem?

The Merge does not change anything for ETH holders and other non-node operating users. There are a few necessary adjustments required of operators, developers and providers, though.

Users that own or use ETH do not need to change or update anything on their wallets or funds because of the Merge. Wallets work just the same as they did pre-Merge, and the Ether held in them has not changed in value or quantity. The entire history of the network since genesis also remains intact despite transitioning to a new consensus mechanism.

The only thing that changes for ETH holders is how the network operates and processes transactions. The Merge affects miners, node operators, and developers more than it does regular users. For example:

- Staking node operators and providers will need to run both consensus and execution clients, as third-party endpoints for obtaining execution data will no longer work post-Merge. They will also need to set a fee recipient address for transaction fees and maximal extractable value.

- Infrastructure providers and non-validating node operators will also need to run clients for both the execution layer and the consensus layer.

- Smart contract and decentralized application (DApp) developers need to familiarize themselves with changes related to block timing, block structure, opcode changes, sources of on-chain randomness and more.

How does Ethereum’s new consensus mechanism work?

Whereas miners in a proof-of-work system put their capital at risk by investing energy to validate a block, validators in a proof-of-stake system put their cryptocurrency at stake.

In order for a validator to be up and running on the network, they first need to deposit 32 ETH into a smart contract. Once deposited, the funds are locked and the validator is ready to begin staking. The staked Ether serves as collateral, meaning it can be destroyed if the validator acts maliciously.

There are also other ways to stake Ether aside from running a validator node. One could participate in staking via a centralized exchange, join a staking pool or delegate staking via a staking service provider.

Related: Architectural components of the Ethereum blockchain: What are they?

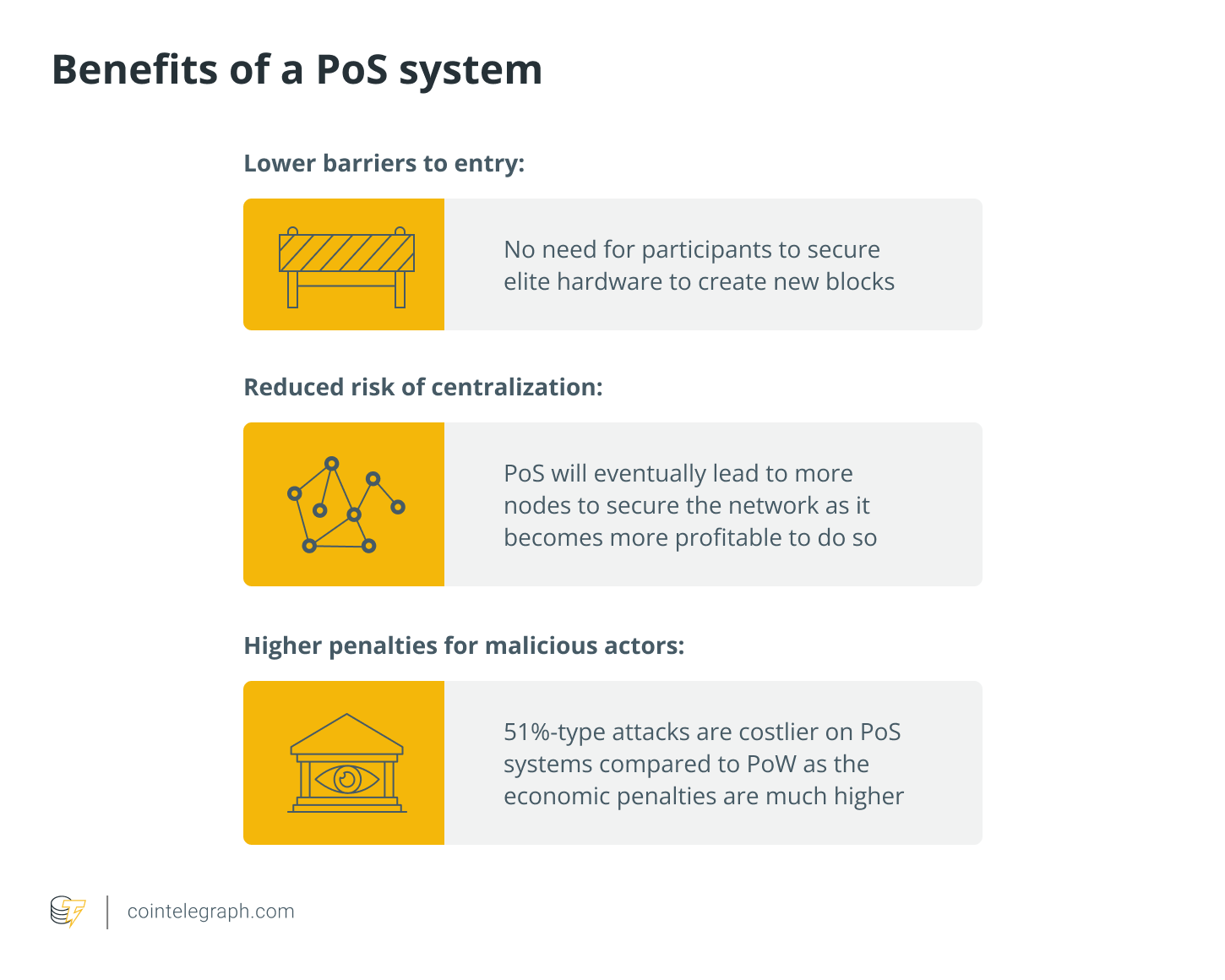

The validator is essentially responsible for checking the validity of new blocks propagated on the network, as well as creating and propagating new blocks. Some of the benefits of a PoS system are:

After the validator executes the transactions in the block, they check the signature of that block to confirm its legitimacy. If it is a valid block, the validator sends an attestation, or vote, for that specific block across the network.

Under PoW, mining difficulty dictates block timing. However, in PoS, the tempo is fixed into slots (12 seconds) and epochs (32 slots). A validator is randomly selected to serve as a block proposer for every slot, during which this validator will be responsible for creating a new block and sending it to other network nodes.

What does the Merge mean for Ethereum miners?

The network now uses proof-of-stake to validate transactions, thereby rendering Ethereum GPU mining largely unprofitable if not completely obsolete.

The Ethereum network’s mainnet has relied on proof-of-work since its genesis, with miners validating blockchain transactions left and right. However, Ethereum’s proof-of-stake layer, or the Beacon Chain, uses builders who bundle transactions together and validators to verify transactions. The amount of cryptocurrency a builder or validator owns will determine their ability to select or validate blocks.

In a bid to make the network more sustainable, the Merge combined these two layers and adopted PoS fully, making Ethereum mining an unproductive way to earn rewards as validators are now more incentivized to preserve the network.

The network previously held around 95% of total GPU hashing power, allowing miners to validate transactions and earn rewards. Under PoS, a validator’s cryptocurrency is at stake, which acts as a disincentive for them to act maliciously.

Following the Merge, Ethereum’s hash rate has also noticeably dropped to zero and has stayed there since. Generally, lower hash rates mean that a network is using less computing power to add and verify transactions on a blockchain. In the case of Ethereum, the drop in hash rate is mainly because miners have either turned off their rigs or switched to other PoW-based cryptocurrencies that are more profitable to mine.

Related: What is PoW Ethereum (ETHW), and how does it work?

What is the Ethereum Merge?

The Merge integrated Ethereum’s original execution layer with its new proof-of-stake consensus layer, officially transitioning the network’s consensus mechanism to proof-of-stake.

Formerly referred to as Ethereum 2.0, Ethereum’s consensus layer has now fully merged with the original blockchain (execution layer). The Merge was completed on September 15, 2022, marking the Ethereum network’s transition from proof-of-work (PoW) to proof-of-stake (PoS). According to the network, the Merge has brought down Ethereum’s energy consumption by around 99.95%.

From a technical perspective, the Merge saw Ethereum’s original execution layer, or the mainnet, merged with its new PoS consensus layer called the Beacon Chain. The Merge is just the first step in Ethereum’s development roadmap, which includes succeeding stages such as The Surge, The Verge, The Purge and The Splurge.

According to Ethereum co-creator Vitalik Buterin, the Merge marks about 55% of the development work set to be done on the network. Ultimately, the goal is to make the network more scalable, sustainable and secure while remaining decentralized.

The Merge eliminated the need for PoW, enabling the network to be secured by Ethereum staking. Staking gives Ethereum holders a chance to collect rewards by providing the necessary computing power to validate transactions and secure the network. This also means that since the Merge, all transactions on the network are now being validated by Ethereum stakers instead of miners.

The second major shift triggered by the move to PoS is the diminished issuance of Ether (ETH) via rewards to validators for their efforts in preserving the network, resulting in ETH becoming a deflationary asset.

Currently, Ethereum’s staking mechanism only accepts deposits that cannot be withdrawn. At the moment, billions worth of ETH is staked on the network — and stuck therein — until a withdrawal feature is added by Ethereum’s developers down the line.

Source