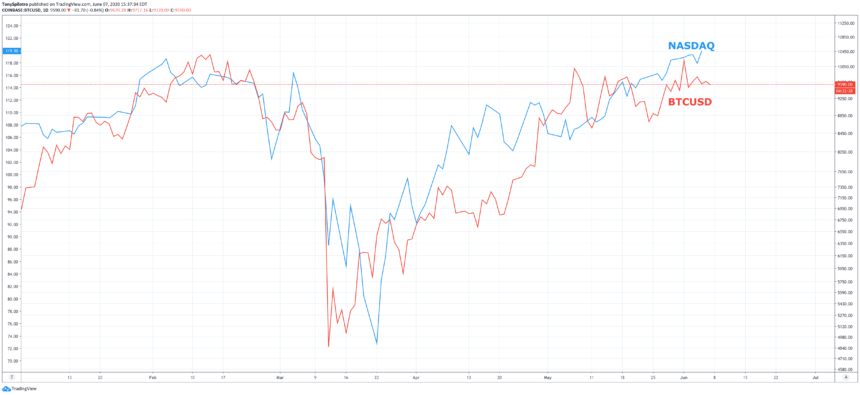

Bitcoin price continues to fail to breach above $10,000 and hold. The last time the cryptocurrency held for consecutive daily closes above the key level, was in February 2020 before the Black Thursday collapse.

During that time, the Nasdaq composite and other major stock indices set a record for a new all-time high. This past week, the Nasdaq set another new record, and it could be a sign that Bitcoin will finally break above $10,000, hold, and finally set a new higher high.

Black Thursday Erased: Nasdaq Composite, NDX, Set New All-Time High

Last week, despite widespread riots and protests across the United States, major US stock indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq composite each saw massive rallies.

Although the Dow and S&P 500 pushed higher toward highs set in February, each index failed to set a new record.

Meanwhile, the Nasdaq composite index and the NASDAQ 100 (NDX) both achieved a higher high and new all-time price record.

Investors are speculating as to if the continued growth in the face of economic disaster and record unemployment is due to stimulus efforts, a continued short squeeze, or if markets are just completely irrational.

It’s as if the Black Thursday panic selloff and pandemic never even happened, according to the stock market.

Related Reading | Bitcoin’s Minute-By-Minute Correlation With Stock Market May Signal Disaster

Bitcoin price also has seen a strong, V-shaped recovery from the extreme lows set in mid-March.

Just as Black Thursday decimated the stock market and precious metals, Bitcoin and the rest of the crypto asset class dropped by 50% or more. Some altcoins even flash crashed to nearly zero.

Surging Stock Market Could Be The Boost Bitcoin Needs For A Breakout

The drop kicked off the cryptocurrency’s closest correlation with the stock market, and after that, Bitcoin has remained relatively correlated since.

Most comparisons have been with the S&P 500, however, the cryptocurrency has demonstrated a recent correlation with tech stocks – which the NDX is filled with – all the way down to the way each daily candle has closed.

BTCUSD, however, is lagging just behind these tech stocks which could indicate that the leading crypto asset by market cap will also set a higher high soon, just as the Nasdaq and NDX have.

This doesn’t necessarily mean that Bitcoin will set a new all-time high as the Nasdaq did, but it could indicate a new higher high is next.

Related Reading | Strong Correlation Between Bitcoin and Stock Market May Finally Be Over

A higher-high in Bitcoin price would be the first since the June 2019 top at $14,000. It would also likely be a clear breakout of a nearly three-year-long triangle.

A breakout from the triangle, while clearing $10,000 – all while the stock market sets record after record – could be the boost Bitcoin needs for the next bull market to finally begin.

Source