Peter Brandt, a well-regarded veteran trader, recently emphasized the high demand from institutions as a key catalyst for Bitcoin’s strong performance.

BTC/USD 1-month chart. Source: TradingView

BTC/USD 1-month chart. Source: TradingView

The strong high time frame technical structure of BTC, especially the weekly chart, and the strengthening fundamentals are buoying the market sentiment. In a tweet, Brandt posted the above chart and said:

“Bitcoin—IF the current gains hold through end of Oct—is poised for the second-highest monthly close ever. $BTC Institutions are increasingly involved in Bitcoin ownership. Institutions mark the value of their assets monthly.”

In addition to the rise in trading volume and growing institutional appetite, investors are referring to the logarithmic chart to forecast a broader rally.

Raoul Pal focuses on the Bitcoin log chart

The log price chart is the most widely used scale by most technical analysts. A logarithmic chart simply means a chart that represents common percent changes with equal spacing in a scale.

Raoul Pal, the founder and CEO of Real Vision Group, says Bitcoin’s monthly log chart is highly optimistic. He wrote:

“Its a bitcoin kind of day. The monthly log chart with regression lines is really something to behold. One of the nicest, post powerful chart patterns I’ve ever seen.”

The technical reason behind the optimism towards the monthly log chart is mainly its clean breakout. Throughout the past four years, $13,000 has acted as a heavy resistance level.

The historical log chart of Bitcoin. Source: Raoul Pal

The historical log chart of Bitcoin. Source: Raoul Pal

As such, on high time frame charts, like the weekly and the monthly chart, BTC always closed below $11,000, except for 2020.

Bitcoin’s clean technical breakout on the monthly timeframe is leading traders and investors like Brandt and Pal to make strong bullish calls on BTC’s price action. As Pal said, “if history rhymes, 2021 is going to be a BIG year.”

BTC/USD 1-month chart. Source: TradingView.com

BTC/USD 1-month chart. Source: TradingView.com

Q4 2020 may end on a positive note

Apart from the numerous bullish technical and fundamental catalysts, the timing of the current rally is also in favor of a major Bitcoin bull cycle.

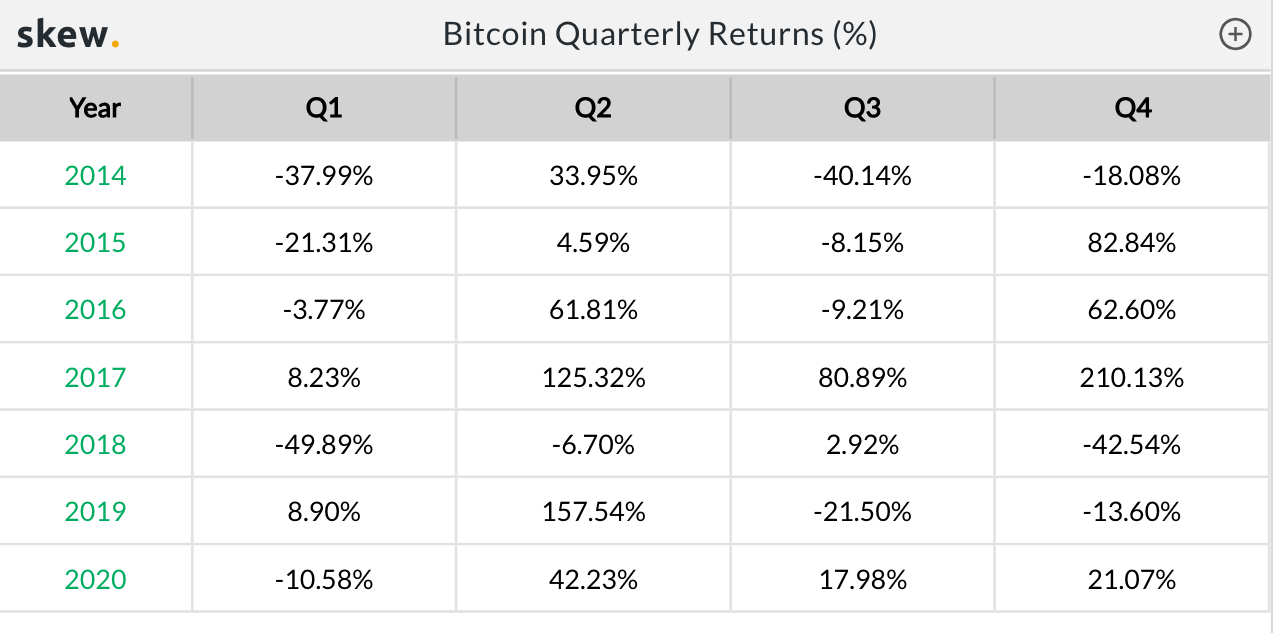

Bitcoin quarterly returns in percentage. Source: Skew

Bitcoin quarterly returns in percentage. Source: Skew

According to data from Skew, Bitcoin had not had three positive consecutive quarters since 2017. During that year, BTC reached its all-time high at $20,000 following its second block reward halving in 2016.

Bitcoin could possibly be on track to record a massively positive gain in the fourth quarter if it stays above $12,000. If so, that could lead to the same bull cycle pattern as 2017. Next year would also present the same post-halving cycle BTC saw in 2017, which further strengthens the narrative of a newfound bull cycle.

Source