Bitcoin and the wider cryptocurrency market took a beating in the late ho April 22, and intense selling saw (BTC) price dip below $48,000 in a move that came as a relief to quantitative analysts like PlanB who were worried that the price growth was showing signs of being inorganic.

A variety of factors have been identified as being the cause of the drop in price, including an overcrowded futures market and heavy selling activity from small- to medium-size whales. Aside from the activity of whales in the crypto market, the most impactful development was a proposal from the administration of United States President Joe Biden to raise the capital gains tax for individuals making more than $1 million per year.

Data from Cointelegraph Markets and TradingView shows that a heavy wave of selling led to a break below the $50,000 support level for Bitcoin on April 23, dropping the price to a low of $47,500 before a few courageous buyers arrived to lift it back above $49,000.

BTC/USDT 4-hour chart. Source: TradingView

BTC/USDT 4-hour chart. Source: TradingView

The breakdown below $50,000 marks a 25% drawdown from the recent all-time high and now has Bitcoin trading at levels last seen in early March.

Bitcoin inflows to exchanges preceeded the downturn

When asked about April 22’s price action, Micah Spruill, managing partner and chief investment officer at S2F Capital, indicated that the sell-off “appears to be an attempt to pin the price below the key $50,000 level where a significant number of put options would expire in the money.”

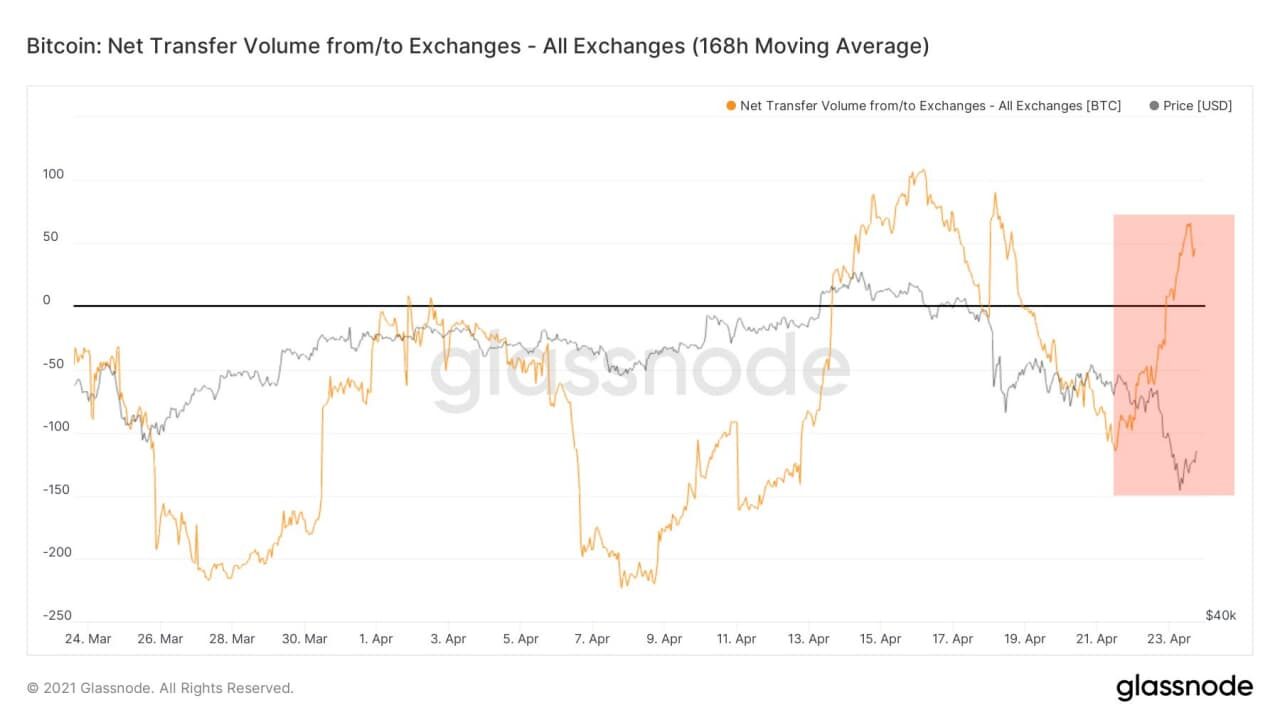

Spruill noted that “bearish net inflows of BTC transfers to exchanges” were the likely catalyst that “drove us down to the next level of on-chain support around $47,500,” and also highlighted the fact that “Most of the coins moved on-chain during this most recent selloff were recently acquired coins and not long term holder coins.”

Net transfer of Bitcoin to/from exchanges. Source: Glassnode, S2F Capital

Net transfer of Bitcoin to/from exchanges. Source: Glassnode, S2F Capital

According to Élie Le Rest, partner at digital asset management firm ExoAlpha, being able to hold the current price level “would confirm the accumulation pattern by institutional investors at or below $50,000, leaving room to grow for Bitcoin in the coming weeks/months.”

If the price should fall further, Le Rest identified $43,000 as the next strong support level, and he highlighted the fact that altcoins really began to “flourish” the last time BTC traded in this range in February.

Le Rest said that “getting back to this level may trigger a strong downside for the altcoin market as they would have lost all of their recent gains,” potentially leading to a rise in Bitcoin dominance back above 60%.

Le Rest said:

“Either way, this kind of market pullback is very healthy as it contributes to deleveraging market participants and builds ground for a more stable growth.”

Traders rush to the exits

To help better understand the rapid sell-off in the price of Bitcoin, Jarvis Labs co-founder Ben Lilly offered an analogy that alluded to traders acting like passengers on a boat to help describe what happened as a “spontaneous synchronization.”

Lilly said:

“When a boat starts to tip, a few people lean first. The more it leans, the more people also lean. Then bam, it tips…”

Lilly pointed to several opportunities that traders used to make money off this downturn including “selling the altcoin euphoria” as well as profiting from the futures carry trade. He also highlighted the fact that capital was being used to short, not to buy, in these instances.

As an indication of how rapidly the market sold off and the degree to which it caught even institutional traders by surprise, Whalemap, an on-chain analytics firm, posted the following tweet highlighting the significance of the $55,000 level.

55k should have been the bottom. 263 thousand bitcoins inflowed to whale wallets at that price. In the future, it could be a trouble area for BTC. But let’s see what happens. Currently, we are at support. pic.twitter.com/Ooo20xlYzq

— whalemap (@whale_map) April 23, 2021

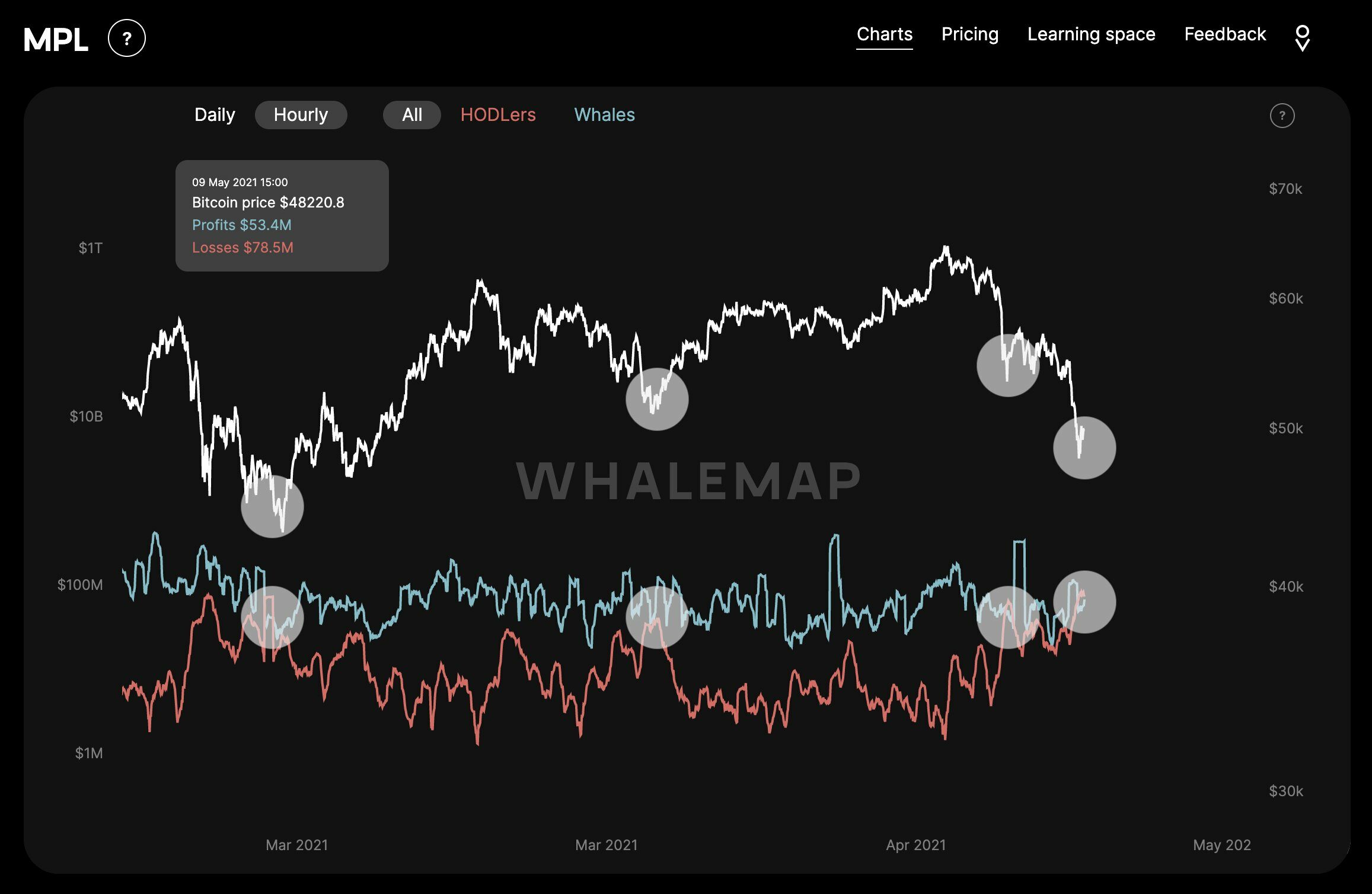

As for what analysts think about buying BTC below $50,000, Whalemap posted the following chart and said:

“Hourly moving losses are higher than profits. Historically that was a good buying opportunity.”

Bitcoin moving profits and losses (MPL). Source: Whalemap

Bitcoin moving profits and losses (MPL). Source: Whalemap

The market now anxiously awaits the next major move in Bitcoin’s price to help determine if this is merely an overdue correction that will lead to a continuation of the bull market or the opening salvo of the next bear market cycle.

Altcoin prices collapse

Bitcoin’s drawdown hit the altcoin market especially hard, resulting in double-digit losses for a majority of the top 100 tokens.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360

Ether (ETH), the top altcoin by market capitalization, was pummeled and at the time of writing trades more than 12% away from its April 22 all-time high of $2,640. Meanwhile, XRP and DOGE have been the hardest-hit tokens in the top 10, with their prices falling more than 20%.

Three notable exceptions to the current sell-off include Compound’s COMP, WAVES and Helium’s HNT, which managed to overcome the selling by posting gains of 13%, 9% and 8%, res at the time of writing.

The overall cryptocurrency market cap now stands at $1.862 trillion, and Bitcoin’s dominance rate is 50.7%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, andyou should conduct your own research when making a decision.

Source