Yearn.finance’s YFI governance token has seen some massive momentum today, with the cryptocurrency’s price rocketing higher as buyers take control of its mid-term trend.

The crypto is in the process of trying to break above its crucial near-term resistance, which sits at roughly $18,000. It has made a few breaks above this level, but each time it is met with inflows of selling pressure.

Where it trends in the near-term may depend largely on whether or not this level can be easily surmounted in the days and weeks ahead. If buyers struggle to shatter the selling pressure that sits here, it could be a grave sign that indicates downside is imminent.

The broader DeFi sector has been seeing some immense strength throughout the past few days.

This has come about as yields start increasing for the yVaults and on liquidity pairs on multiple platforms.

This will undoubtedly bolster the price action seen by yield aggregator assets, including Yearn.finance.

For it to rally higher, Ethereum must remain strong, as ETH is the DeFi ecosystem’s backbone.

Yearn.finance’s YFI Token Soars to Key Resistance

At the time of writing, Yearn.finance’s YFI token is trading up over 15% at its current price of $18,000. This marks a massive upswing from daily lows of $15,990 set just a handful of days ago.

Last week, when the cryptocurrency’s price plunged to lows of $7,500, the buying pressure here sparked a nearly instant buying frenzy that caused it to rally as high as $18,000.

The resistance here was intense and held strong ever since, but it is now showing signs of strength as bulls try to break above this key level.

This Major Fund Has Been Loading up on YFI

Polychain – a major crypto venture fund – has been loading up on Yearn.finance’s YFI token throughout the course of its recent selloff, now holding 1.6% of the total supply.

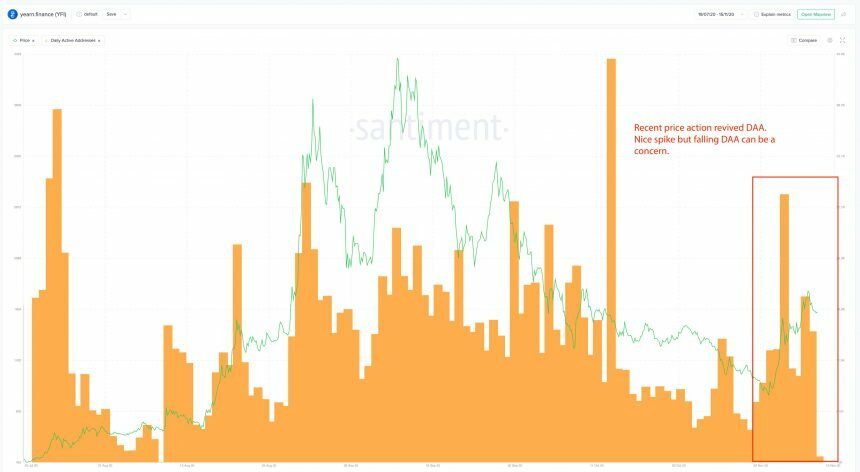

Analytics firm Santiment spoke about this in a recent tweet, explaining that some large sellers have also closed short positions on the token.

“Are we seeing the return of the DeFi darling, YearnFinance? Over the past week, the segment has dominated crypto return leaderboards. A whale has actually closed his short after Crypto Twitter went short hunting – attempting to force liquidate the whale. Meanwhile PolyChain has brought their total holdings to 470 YFI ($8m or 1.6% of the total supply).”

Image Courtesy of Santiment.

Where Yearn.finance’s YFI trends next will likely guide the entire DeFi sector, making it vital that bulls take control.

Featured image from Unsplash. Charts from TradingView.

Source