Bitcoin’s price has been flashing signs of immense weakness throughout the past few days, with the recent $19,500 rejections sending it reeling lower as analysts watch for further downside.

The rejection just below its all-time highs was certainly what sparked the ongoing correction, but some other factors are at play here.

One such factor is recent comments from the U.S. Treasury Secretary regarding a potential wave of regulations on the crypto market before leaving his position in late-January. It remains unclear if the next administration pursues the same aggressive approach to crypto.

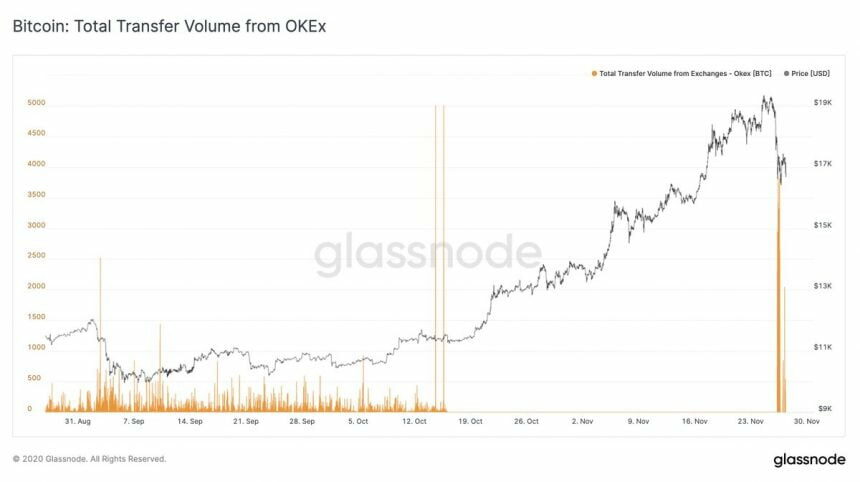

Another factor that may actually be the main impetus of this selloff is OKEx, enabling withdraws for users that previously had their Bitcoin locked on the platform for well over a month.

This coincided closely with the recent selloff, which indicates that it may be a factor.

Data from an analytics firm shows that in total, 212,000 BTC has left the platform since withdraws were resumed. Traders who had their crypto locked throughout the course of the recent rally may have taken this as an opportunity to take profits off the table.

Bitcoin Struggles to Gain Momentum as Selling Pressure Ramps Up

At the time of writing, Bitcoin is trading up just over 2% at its current price of $16,780. This marks a massive decline from its recent highs of $19,500 set at the peak of the recent uptrend.

The decline that has forced BTC into the $16,000 region came about directly after the rejection at its all-time highs, signaling that the selling pressure here is significant and may continue hampering its price action in the days and weeks ahead.

Where it trends in the mid-term may depend largely, or entirely, on whether or not bulls can reclaim $17,000 – which was previously a key support level.

Data Suggests OKEx Withdraws May Be Driving Ongoing Selloff

One of the main factors behind the $3,000 selloff Bitcoin has seen since reaching its all-time highs is OKEx enabling withdraws.

As one on-chain analytics platform explained:

“Since yesterday’s announcement from OKEx to resume withdrawals, we have seen an outflow of 29,300 BTC from the exchange. In the same time period 21,600 BTC have been deposited, reducing the exchange’s balance to ~212k BTC.”

Image Courtesy of Glassnode.

The coming few days should provide insight into where Bitcoin is trending in the mid-term. Because most of the previously locked BTC on OKEx has been withdrawn already, there’s a strong possibility that this selloff will begin cooling down.

Featured image from Unsplash. Charts from TradingView.

Source