Bitcoin and ether continue to make gains Friday and stakeholders are increasingly investing their crypto into DeFi.

- Bitcoin (BTC) trading around $11,333 as of 20:00 UTC (4 p.m. ET). Gaining 2% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,974-$11,460

- BTC above 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Coinbase since July 28. Source: TradingView

Bitcoin’s price pushed as high as $11,460 on increased buying volume Friday, continuing its bullish run to cap a week of economic uncertainty.

“The U.S. Q2 GDP results were rough and traditional markets are seeing a bit of risk off – a sharp move lower in yields and weakness in stocks,” Dan Koehler, liquidity manager for cryptocurrency exchange OKCoin, told CoinDesk. “It’s a crucial time for bitcoin, in my view.”

Indeed, stocks are taking a beating Friday, with major global indexes down or flat.

Bitcoin (gold), S&P 500 (blue), FTSE 100 (green) and Nikkei 225 (red) in July. Source: TradingView

Bitcoin (gold), S&P 500 (blue), FTSE 100 (green) and Nikkei 225 (red) in July. Source: TradingView

Bitcoin beat major equity indexes for July, up over 20% for the month. “It will be interesting to see how bitcoin behaves in a risk-off environment this time around, having broken and thus far held above $10,400,” added OKCoin’s Koehler.

Michael Rabkin, head of institutional sales at crypto trading firm DV Chain, said a positive news cycle on the crypto front is helping the market. “We’ve been seeing more buying over the last few days, specifically since the past week’s announcement which would allow banks to hold custody,” he said.

“There’s definitely a more bullish sentiment since that announcement came out and as we’ve seen, has resulted in upward momentum,” Rabkin added

Mostafa Al-Mashita of Global Digital Assets, a digital assets-focused merchant bank, said alternative cryptocurrencies, or altcoins, is where he expects traders to take profits near-term. “The market is consolidating as altcoins catch up to the recent bitcoin pump,” he said. “I would expect altcoins to lead for a few days before bitcoin rising again.”

DeFi locked at $4B

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Friday, trading around $344 and climbing 3.1% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

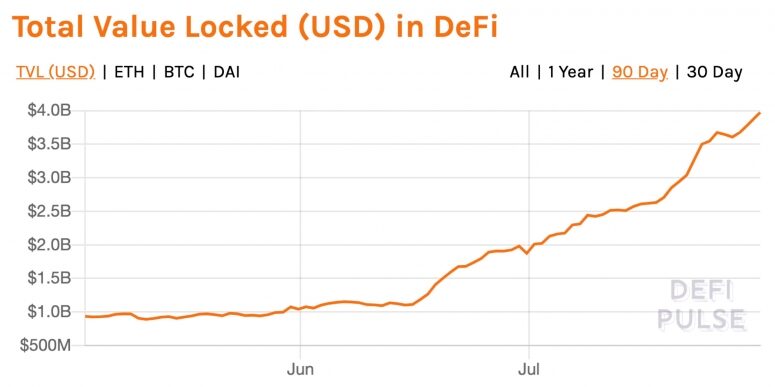

Since June 1, the total value locked in Ethereum-powered decentralized finance, or DeFi, has risen 300% from $1 billion to $4 billion, according to data aggregator DeFi Pulse.

Total locked in DeFi the past three months. Source: DeFi Pulse

Total locked in DeFi the past three months. Source: DeFi Pulse

In just two months, total bitcoin locked in DeFi more than quadrupled from 4,975 to 20,610 BTC. Total ether locked in DeFi has grown 60%, from 2.6 million to 4.2 million ETH. Stablecoin dai locked is up 19%, from 365 million to 435 million.

Azamat Malaev, co-founder of HodlTree, a new DeFi protocol for interest-yielding tokens, said the catalyst for this growth was investors locking crypto with a particular big DeFi lender to achieve “yield” or profit. ”It started with the launch of the Compound token distribution on June 15,” he said. “And, of course, with a time delay information began to spread.”

Other markets

Digital assets on the CoinDesk 20 are mostly higher Friday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Gold is up 0.90% and at $1,973 as of press time.

- Oil is flat, in the green 0.12%. Price per barrel of West Texas Intermediate crude: $40.37

- U.S. Treasury bonds all slipped Friday. Yields, which move in the opposite direction as price, were dow most on the two-year, in the red 12%.

Disclosure

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Source