Some bitcoin investors appear to be buying in around $30,000 and taking profits at $40,000, according to one analyst. Meanwhile, ether’s spot market is decoupling from bitcoin and gyrating wildly, according to volatility metrics.

- Bitcoin (BTC) trading around $32,963 as of 21:15 UTC (4:15 p.m. ET). Gaining 3.5% over the previous 24 hours.

- Bitcoin’s 24-hour range: $31,650-$34,893 (CoinDesk 20)

- BTC above the 10-hour and the 50-hour moving averages on the hourly chart, a bullish signal for market technicians.

Bitcoin trading on Bitstamp since Jan. 22. Source: TradingView

Bitcoin trading on Bitstamp since Jan. 22. Source: TradingView

The price of bitcoin made gains opening the week, rallying from as low as $31,640 at around 21:00 UTC (4 p.m. ET) Sunday to as high as $34,893 at around 14:00 UTC (9 a.m. ET) Monday. The price has slipped a bit since then, with the world’s oldest cryptocurrency changing hands around $32,963 as of press time.

“A clean break above $34,500 and more sustainably above $36,000 is needed,” David Lifchitz, chief investment officer of quant trading firm ExoAlpha, told CoinDesk. “We could also be in for a classic ‘W’ bottom when the first bounce off the lows is met by another batch of selling before it eventually bounces back for real.”

So far this year, bitcoin is up over 13% on spot exchanges such as Luxembourg-based Bitstamp.

Spot bitcoin performance on Bitstamp in 2021. Source: TradingView

Spot bitcoin performance on Bitstamp in 2021. Source: TradingView

“Everyone is seeing good buying at the low end of the $30,000s, so clearly the institutions are comfortable entering there,” noted Chris Thomas, head of digital asset for Swissquote Bank. “We’ve previously seen strong selling around $40,000 so these will be the big tests over the next week or two.”

“I’d imagine there are a few big names we don’t yet know of currently buying up bitcoin,” Thomas added. “We’ll likely discover them very soon, by which point they will have accumulated quite substantial volumes.”

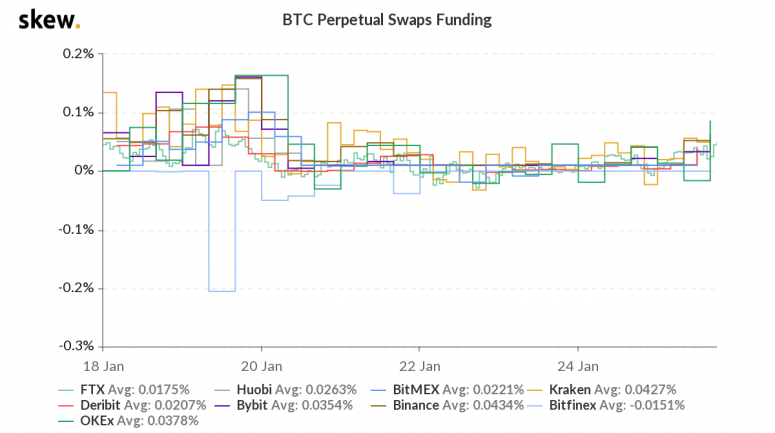

On the perpetual swaps market, where liquidity providers put up crypto for traders to leverage, funding rates are trending back up, particularly on OKEx, which is offering 0.0865%, its highest since Jan. 20. This is a signal leveraged traders are willing to start paying up to position themselves long.

Bitcoin swaps funding the past week. Source: Skew

Bitcoin swaps funding the past week. Source: Skew

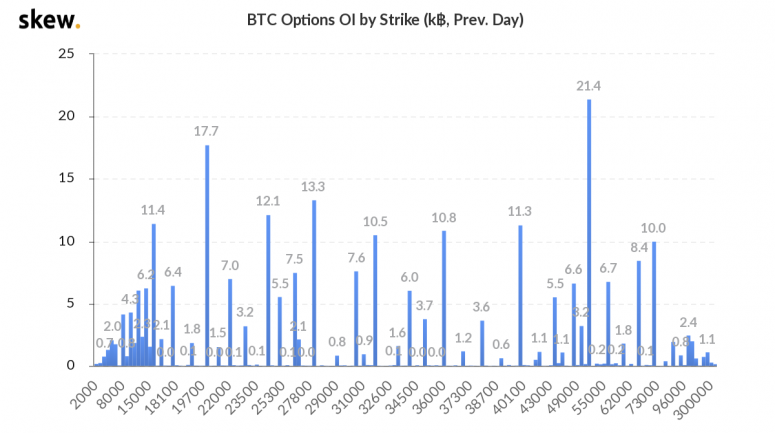

In the options market, a bullish bitcoin mentality appears to be forming. Open interest (OI) by strikes is highest at the $52,000 price point as of Sunday, with 21.4 BTC in OI. Second place is much more bearish, however, with 17.7 BTC piled up at the $20,000 spot level.

Bitcoin options open interest by strike. Source: Skew

Bitcoin options open interest by strike. Source: Skew

“I think both bitcoin and ether will continue to see higher highs,” said Michael Gord, chief executive officer trading firm Global Digital Assets. “But as we saw in the previous bull run when bitcoin cools off, the spotlight moves to ether and when BTC & ETH are cooled down, we start to see altcoins shine,” Gord added. “That’s what I expect to see the next couple weeks.”

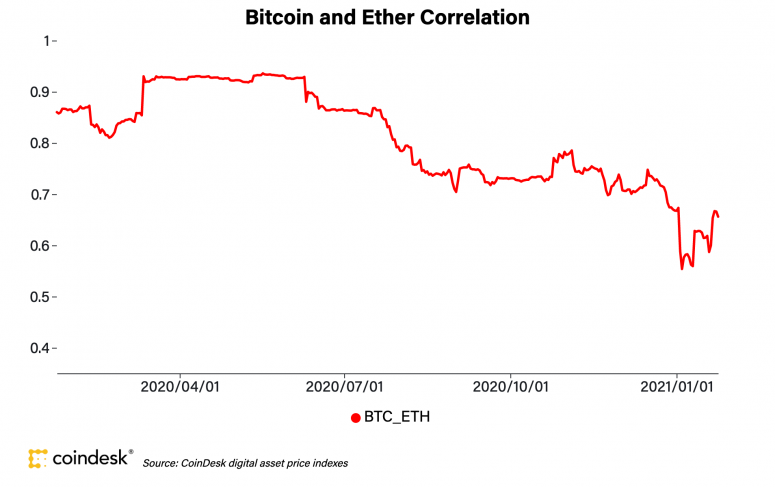

Something to watch: Ether’s decoupling from bitcoin. Over the past year, the correlation between bitcoin and ether has slipped.

Bitcoin and ether 90-day correlation the past year. Source: Shuai Hao/CoinDesk Research

Bitcoin and ether 90-day correlation the past year. Source: Shuai Hao/CoinDesk Research

On Jan. 24, 2020, the 90-day correlation was at 0.86. A 90-day correlation of 1 means highly correlated. On Sunday, Jan. 24, 2021, that figure was at 0.66.

Ether gets volatile

The second-largest cryptocurrency by market capitalization, ether (ETH), was flat Monday, trading around $1,342 and in the red 0.08% in 24 hours as of 21:15 UTC (4:15 p.m. ET).

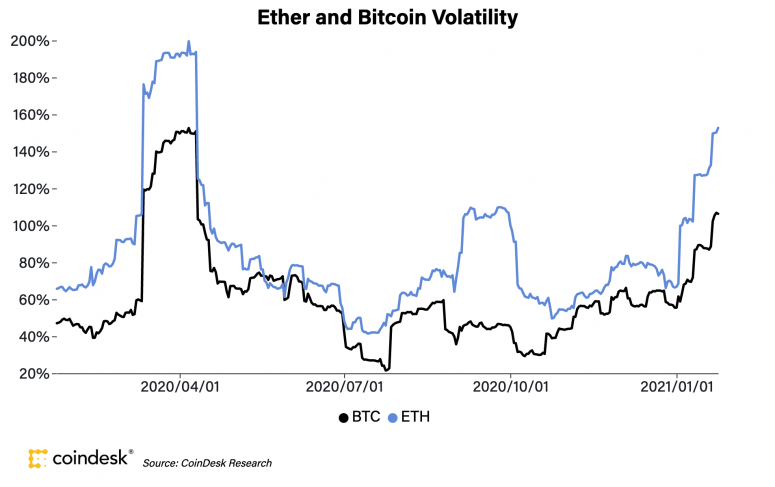

Ether’s 30-day volatility, a measure of the asset’s gyrations on the spot market, has risen dramatically since the start of the year. On Jan. 1, 2021, volatility was at 66.87%. On Sunday, Jan. 24, that number hit 152.67%, the highest since April 2020’s coronavirus-induced market crash. It’s also much higher than bitcoin’s 106.33% volatility as of Jan. 24.

Ether and bitcoin’s 30-day volatility the past year. Source: Shuai Hao/CoinDesk Research

Ether and bitcoin’s 30-day volatility the past year. Source: Shuai Hao/CoinDesk Research

Greg Magadini, chief executive officer of data aggregator Genesis Volatility, said that while the increased price fluctuations might be an opportunity for some traders, he’s cautious about any bearish downside.

“We noted in our newsletter that ETH volatility is historically very high but we are cautious to short it, compared to BTC,” Magadini told CoinDesk. “ETH has room to run. A spike to over $2,000 in quick fashion is definitely in the cards for ETH.”

Other markets

Digital assets on the CoinDesk 20 are mixed Monday. Notable winners as of 21:15 UTC (4:15 p.m. ET):

- Oil was up 1.3%. Price per barrel of West Texas Intermediate crude: $52.72.

- Gold was flat, in the green 0.01% and at $1,854 as of press time.

- The 10-year U.S. Treasury bond yield fell Monday to 1.030 and in the red 6.3%.

The CoinDesk 20: The Assets That Matter Most to the Market

The CoinDesk 20: The Assets That Matter Most to the Market

Source