Bitcoin’s price is turning bullish as ether options traders accumulate half a million of ETH options for December expiration.

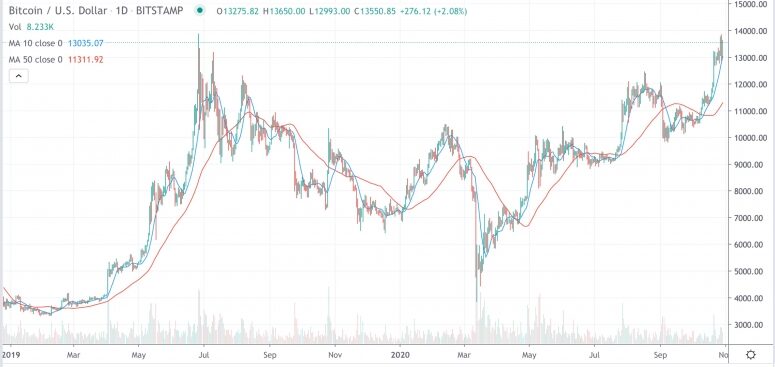

- Bitcoin trading around $13,519 as of 20:00 UTC (4 p.m. ET). Gaining 2.6% over the previous 24 hours.

- Bitcoin’s 24-hour range: $13,105-$13,649

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Bitstamp since Oct. 27. Source: TradingView

Bitcoin trading on Bitstamp since Oct. 27. Source: TradingView

The price of bitcoin moved upward Thursday, going as high as $13,649, according to CoinDesk 20 data, and settling around $13,519 as of press time.

Often when other asset classes like stocks sell off, as they did on Wednesday, bitcoin drops. “It would not be the first time bitcoin’s price action falls in line with traditional markets as a general sell-off occurs,” said John Willock, CEO of Tritium. “However, it is also totally reasonable for BTC to experience this level of pullback.”

Yet, on Thursday equities fared better, particularly in the United States.

Constantin Kogan, a partner at crypto fund-of-funds BitBull Capital, sees no reason why the world’s oldest cryptocurrency can’t go higher in the near term. “Bitcoin is heading for $13,800 resistance and 2019 all-time highs,” Kogan told CoinDesk. “It might break $13,800.”

Daily spot bitcoin trading on Bitstamp. Source: TradingView

Daily spot bitcoin trading on Bitstamp. Source: TradingView

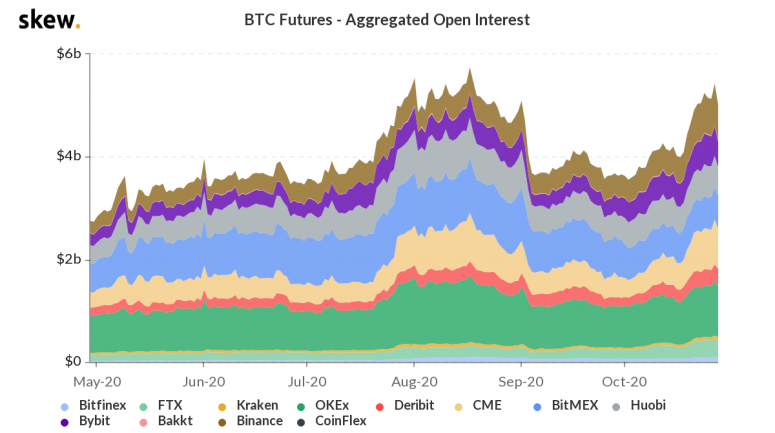

Taking a look at the bitcoin futures market, open interest has picked up, going to levels not seen since August.

“We are almost at new highs for open interest for all BTC futures – $5.4 billion right now,” noted Jason Lau, chief operating officer for San Francisco-based cryptocurrency exchange OKCoin. “With many new positions being opened, it suggests the market is still bullish at these prices,” Lau added.

Bitcoin futures open interest the past six months. Source: Skew

Bitcoin futures open interest the past six months. Source: Skew

“That said, there are a considerable amount of order book ‘asks’ in the $14,000 region for bitcoin,” Lau said. “Bitcoin should close above that level on a weekly or monthly basis to confirm it is acting as support.”

Ether options in December pile up

The second-largest cryptocurrency by market capitalization, ether was up Wednesday trading around $389 and climbing 1.1% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

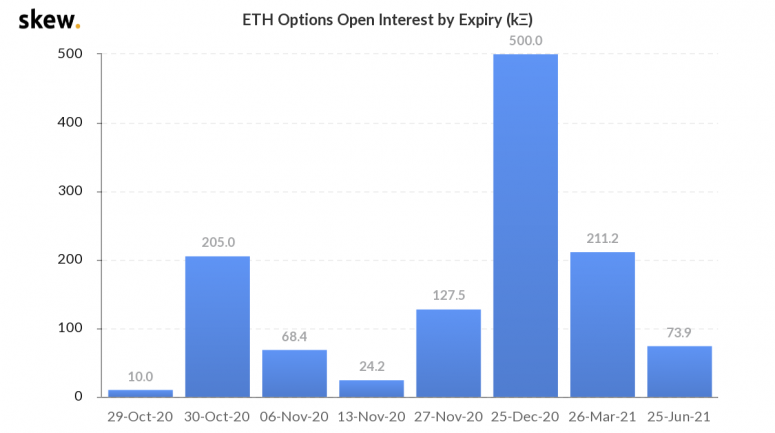

The amount of open interest on ether options for December expiration hit 500,000 ETH, worth $195,500,00 as of press time, as traders make bets on the dynamics of the Ethereum network.

Ether options open interest by expiration date. Source: Skew

Ether options open interest by expiration date. Source: Skew

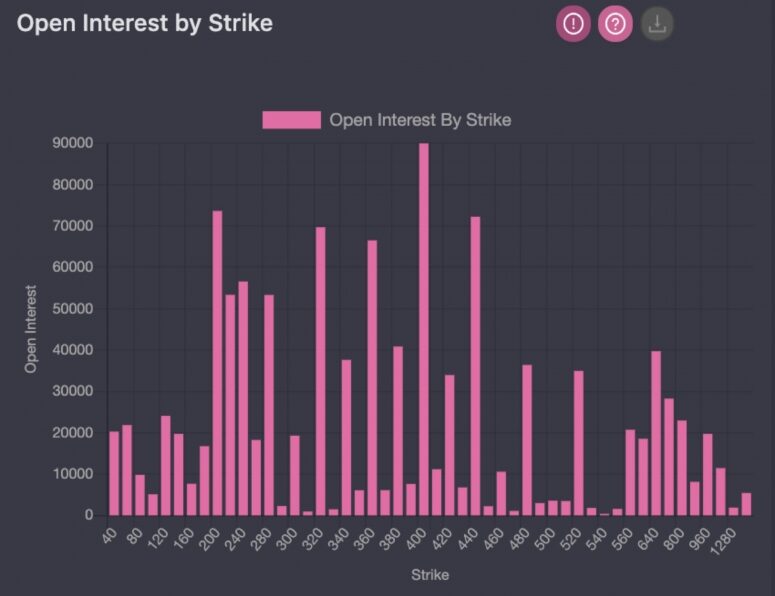

Vishal Shah, an options trader and founder of derivatives exchange Alpha5, noted that a lot of ether options bets seem bearish. “It looks like there’s some strong ETH put buying going on into the year end mainly around the mid-low $200s,” he said. Indeed, data aggregator Genesis Volatility shows strikes amassing around the $200-$280 price points.

Open interest by strike on top ether options venue Deribit. Source: Genesis Volatility

Open interest by strike on top ether options venue Deribit. Source: Genesis Volatility

“I think people are buying the downside for some reason,” Shah added. “It definitely throws water on the narrative that Ethereum 2.0 would create a supply shock in Ethereum 1.0 due to the initial lock-up – perhaps it is something else, but it’s definitely hard to glean any bullish implications.”

Other markets

Digital assets on the CoinDesk 20 are mixed, mostly red Thursday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

- Oil was down 2.8%. Price per barrel of West Texas Intermediate crude: $36.31.

- Gold was in the red 0.34% and at $1,869 as of press time.

- U.S. Treasury bond yields climbed Thursday. Yields, which move in the opposite direction as price, were up most on the 10-year, jumping to 0.830 and in the green 7.3%.

The CoinDesk 20: The Assets That Matter Most to the Market

The CoinDesk 20: The Assets That Matter Most to the Market

Source