The bitcoin market is experiencing low volume Monday but ether continues to fuel DeFi’s growth.

- Bitcoin (BTC) trading around $11,737 as of 20:00 UTC (4 p.m. ET). Gaining 0.34% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,592-$11,823.

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Coinbase since August 22. Source: TradingView

Bitcoin trading on Coinbase since August 22. Source: TradingView

Bitcoin’s price opened the week heading higher, hitting $11,823 on Monday before dipping lower. “Bitcoin has settled into a consolidation position at $11,700,” said Daniel Koehler, liquidity manager at cryptocurrency exchanges OKCoin. “It appears that traders are waiting for better fills at $11,000,” he added.

Bitcoin spot trading on Coinbase the past two weeks. Source: TradingView

Bitcoin spot trading on Coinbase the past two weeks. Source: TradingView

Darius Sit, managing partner of quantitative trading firm QCP Capital, expects the final full week of August to be quieter than earlier in the month, when the world’s oldest cryptocurrency hit a 2020 high of $12,485 on spot exchanges like Coinbase.

“One thing we were looking at is that August tends to be a weak month for both BTC and ETH,” said Sit. “So if that seasonality plays out, this last week of August might see some weakness.”

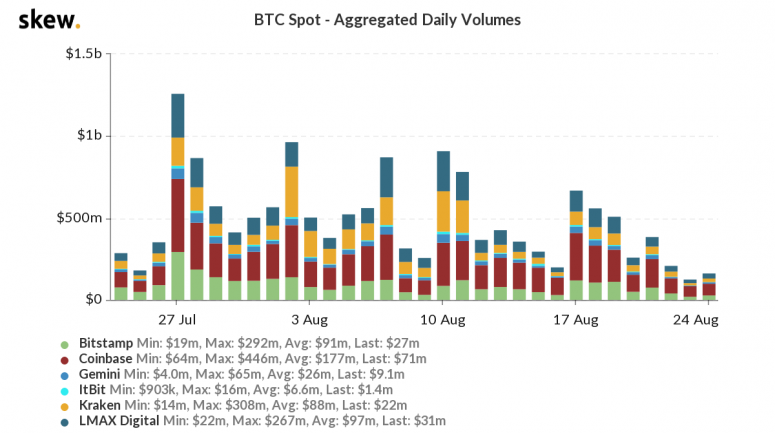

Spot volumes on major BTC/USD exchanges Monday are low. For Luxembourg-based Bitstamp, for example, it was just $27 million, well below its $91 million daily average.

Spot volumes on major USD/BTC exchanges. Source: Skew

Spot volumes on major USD/BTC exchanges. Source: Skew

Interestingly, there are more addresses now with 1,000 or more bitcoin than ever before. The count of those on the “Bitcoin Rich List” has reached a high of 2,190. Those addresses hold nearly 7.87 million BTC, the equivalent of $92.2 billion.

Nonetheless, many stakeholders who are usually bullish are expecting some retrenchment from bitcoin’s price gains, including Rupert Douglas, head of institutional trading for digital asset broker Koine. “We’ve come a long way quickly. I wouldn’t be surprised by a pause or a pullback,” Douglas said. OKcoin’s Koehler echoed that sentiment. “Momentum is still signaling bullish, but it’s unclear if we should test the $10,000 breakout area before moving higher,” said.

Douglas also noted ether (ETH) continues to steal bitcoin’s spotlight. “Overall, ETH is stronger and I think will continue to outperform BTC,” he said.

Into the ether

Ether, the second-largest cryptocurrency by market capitalization, was up Monday, trading around $401 and climbing 2.1% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

The amount of “gas” used, denoted in gwei, worth 0.000000001 ether on the Ethereum network, hit an all-time high Sunday, reaching 79,294,213,632 gwei, according to aggregator Glassnode. A unit of measure to execute operations on the network, gas is used within Ethereum to conduct transactions or use smart contracts. The record amount of gas used is viewed as a sign that Ethereum’s utility for decentralized finance, or DeFi, is higher than ever.

Total gas used on Ethereum since the network launched in 2015. Source: Glassnode

However, George Clayton, managing partner of Cryptanalysis CapitaI, has concerns whether Ethereum’s heavy usage can be sustained given that average fees for using the network have gone as high as $6.68 in August. “I think the gas issue is leaving Ethereum vulnerable,” he said, “vulnerable to competing smart contract public blockchains. Something has to give.”

Other markets

Digital assets on the CoinDesk 20 are mostly green Monday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is up 0.29%. Price per barrel of West Texas Intermediate crude: $42.39.

- Gold was in the red 0.64% and at $1,926 as of press time.

- U.S. Treasury bonds all climbed Monday. Yields, which move in the opposite direction as price, were up most on the two-year, in the green 8.4%.

The CoinDesk 20: The Assets That Matter Most to the Market Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

The CoinDesk 20: The Assets That Matter Most to the Market Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Source