Bitcoin is making gains not seen since early September; the amount of BTC locked in DeFi hits six figures.

- Bitcoin (BTC) trading around $10,778 as of 20:00 UTC (4 p.m. EDT). Gaining 0.70% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,252-$10,950

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Coinbase since September 13. Source: TradingView

Bitcoin trading on Coinbase since September 13. Source: TradingView

Bitcoin was able to reach as high as $10,950 on spot exchanges such as Coinbase Tuesday before losing some steam, settling around $10,778 as of press time.

“BTC is making a strong attempt to break out of the recent $10,100 to $10,500 range,” said David Lifchitz, chief investment officer of quant firm ExoAlpha. “We’re just above $10,600 and testing $10,600-$10,800 long enough would position the next target to $11,000.”

Bitcoin trading since the start of September. Source: TradingView

Bitcoin trading since the start of September. Source: TradingView

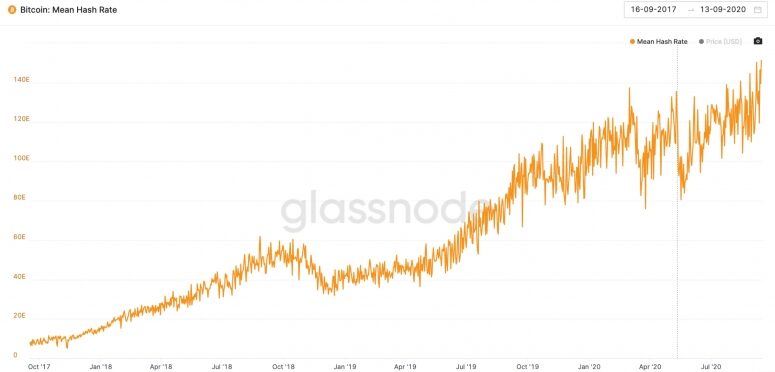

Lifchitz cited factors other than just price as reasons to be optimistic about the world’s oldest cryptocurrency. “From a fundamental point of view, bitcoin mining hashrate is hitting all-time highs,” Lifchitz added. Indeed, the daily average hashrate on the Bitcoin network reached a records 151 million terahashes per second on Monday.

Mean hash rate for the bitcoin network the past three years. Source: Glassnode

Mean hash rate for the bitcoin network the past three years. Source: Glassnode

The rise in hashrate means the next difficulty adjustment, scheduled for Sept. 19, will also likely set a record high. “Difficulty is looking to adjust upwards later this week to its highest ever,” added Lifchitz.

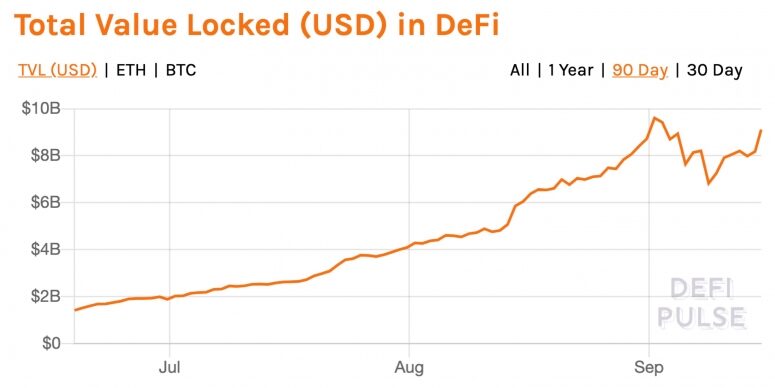

Denis Vinokourov, head of research for brokerage Bequant, also sees other fundamental trends fueling bitcoin’s bullish run. “The reports that MicroStrategy has completed yet another acquisition of 16,796 bitcoins at an aggregate purchase price of $175 million, together with a new wave of money flowing into DeFi as indicated by the total value locked, are all proving to be very supportive for the sentiment,” he said.

Guy Hirsch, U.S. managing director for multi-asset brokerage eToro, noted the amount of bitcoin inactive for at least three years is now over 31%, its highest point since late 2017.

Percentage of bitcoin supply active past three years since September 2017. Source: Glassnode

Percentage of bitcoin supply active past three years since September 2017. Source: Glassnode

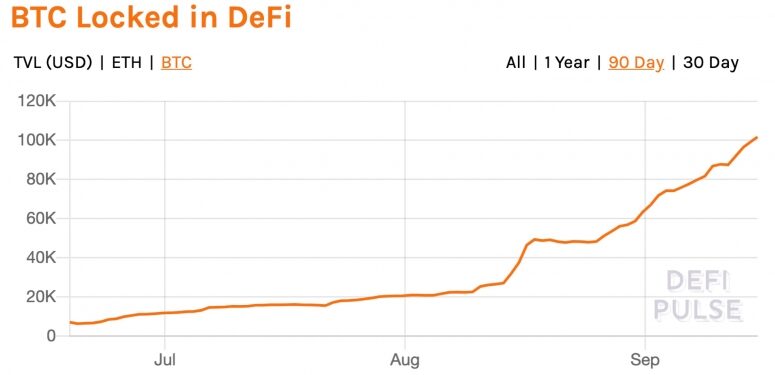

Hirsch attributes some of this bitcoin activity coming from decentralized finance, or DeFi, which can require movement of BTC on-chain. ”We have witnessed more capital going into DeFi projects despite some of them experiencing major issues, and also an increase in bitcoin locked on DeFi,” Hirsch told CoinDesk. “These developments suggest that there has been an increase in HODLing as people and institutions show an increasing willingness to allocate to crypto assets.”

100K BTC locked in DeFi

The amount of bitcoin “locked,” or deployed, in DeFi has crossed the 100,000 mark for the first time, currently at 101,719 BTC, according to aggregator DeFi Pulse.

Total bitcoin locked in DeFi the past three months. Source: DeFi Pulse

Total bitcoin locked in DeFi the past three months. Source: DeFi Pulse

The total is rebounding towards $10 billion in total value, helped by bitcoin’s continued upward trend in total value locked.

Total locked in DeFi in USD terms the past three months. Source: DeFi Pulse

Total locked in DeFi in USD terms the past three months. Source: DeFi Pulse

“The massive and quick growth of the lock-in cannot be denied. It’s kind of mind-blowing,” said Henrik Kugelberg, a Sweden-based bitcoin over-the-counter trader. Kugelberg expects a lot more BTC on DeFi in the future. “While 100,000 BTC is a lot of money it is actually a small part of mined BTC locked in DeFi. I believe the floodgates have opened but it’s still just a stream of bitcoin flowing in.”

Other markets

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Tuesday, trading around $365 and slipping 2.9% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Digital assets on the CoinDesk 20 are mostly in the red Tuesday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is up 2.5%. Price per barrel of West Texas Intermediate crude: $38.25.

- Gold was in the red 0.21% and at $1,953 as of press time.

- U.S. Treasury bond yields climbed Tuesday. Yields, which move in the opposite direction as price, were up most on the 30-year bond, in the green 1%.

The CoinDesk 20: The Assets That Matter Most to the Market

The CoinDesk 20: The Assets That Matter Most to the Market

Source