Bitcoin rebounded from an OKEx-related drop; ether options traders may be beacon chain bearish.

- Bitcoin (BTC) trading around $11,327 as of 20:00 UTC (4 p.m. ET). Slipping 2% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,199-$11,623

- BTC below its 10-day moving average but above the 50-day, a sideways signal for market technicians.

Bitcoin trading on Bitstamp since Oct. 14. Source: TradingView

Bitcoin’s price moved as high as $11,623 late Thursday/early Friday but trades at that height were short-lived. Spot traders punched the sell button around 04:00 UTC (12:00 a.m ET) on the news that Malta-based exchange OKEx suspended withdrawals due to an investigation of a key operations person. Bitcoin fell as low as $11,199 on spot exchanges such as Bitstamp before rebounding a bit, up to $11,327 at press time.

Market analysts seem unfazed, saying OKEx’s situation will hardly affect crypto’s long-term fundamentals. Nonetheless, the circumstances seem a bit curious, according to George Clayton, managing partner of investment firm Cryptanalysis Capital.

“Kind of weird that a major exchange can be incapacitated by one guy,” Clayton told CoinDesk. “One would have thought that there would be contingency plans in place with that much at stake.”

William Purdy, an options trader and founder of analysis firm PurdyAlerts, noted the resilience of the market in the face of negative sentiment. “If this news occured in 2018, the market would have dropped 10%-15%,” he told CoinDesk. “However, now it is supported by the larger equity investors and traditional markets.”

Indeed, despite the drop, the price per one bitcoin is still hovering around the $11,400-$11,500 range it has been in since Oct. 9.

Spot bitcoin trading on Bitstamp in October. Source: TradingView

Spot bitcoin trading on Bitstamp in October. Source: TradingView

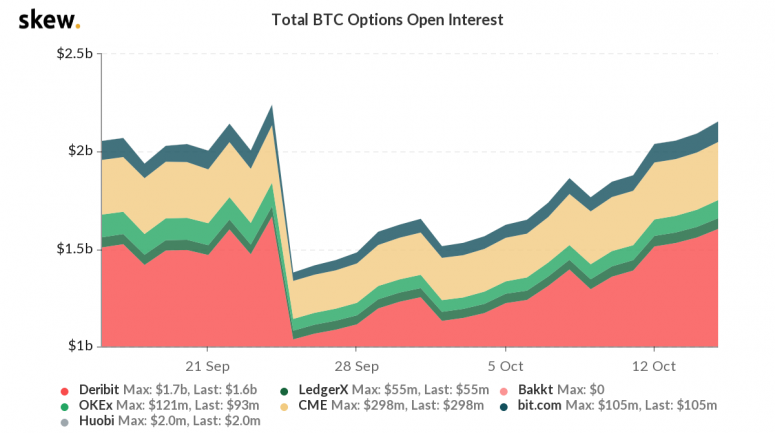

Yet, in the bitcoin options market, traders appear to be preparing for further fallout. Open interest in bitcoin options keeps trending upward, according to Purdy.

Open interest on major bitcoin options venues the past month. Source: Skew

Open interest on major bitcoin options venues the past month. Source: Skew

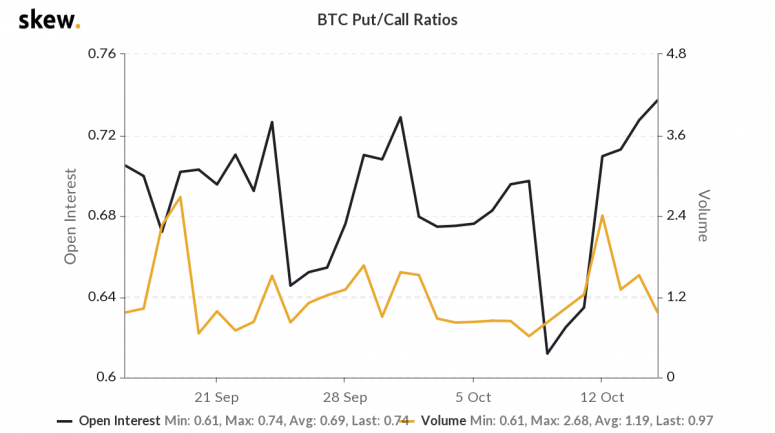

Specifically, Purdy sees a trend with an increase in the put/call ratio on bitcoin options. “High put/call here is bearish positioning by options traders who expect further downside,” he said.

Bitcoin put/call ratios in the options market. Source: Skew

Bitcoin put/call ratios in the options market. Source: Skew

These two trends combined reflect the possibility of big market movements in the near-term by options traders. “Bitcoin options open interest keeps climbing as the put-to-call ratio is seen increasing,” said Purdy. “Given the continuous increase in open interest, we will see a large liquidation move in the coming weeks.”

Lots of ether options expiring in December

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Friday trading around $366 and slipping 3.1% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

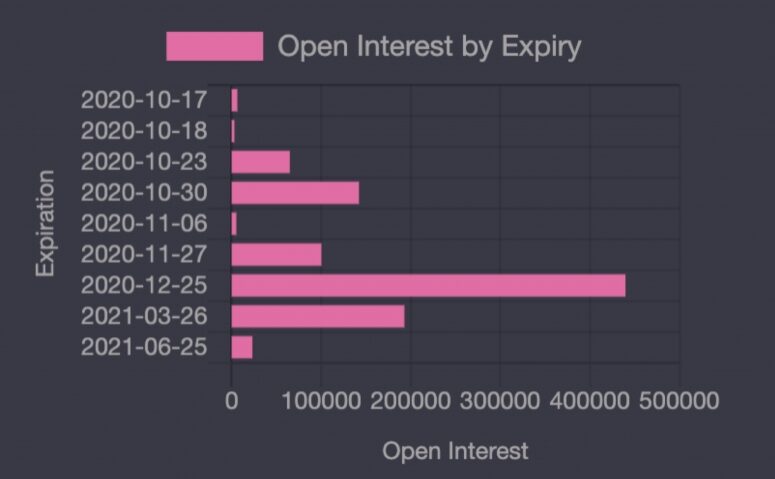

Ether traders are loading up on options for a Dec. 25 expiration. As of press time, 439,813 ETH, worth $161,851,184 at current prices, are set to expire on Deribit, the largest options venue in the market.

Open interest by expiration date on Deribit. Source: Genesis Volatility

Open interest by expiration date on Deribit. Source: Genesis Volatility

Greg Magadini, co-founder and CEO of data aggregator Genesis Volatility, said the large number of options, mostly positioned short, for December expiration has to do with Ethereum’s plan to upgrade its network. Ethereum 2.0’s initiation will begin with the “beacon chain” where investors will stake ether to help jump-start the network. A date has not yet been set for the beacon chain launch but is expected in 2020.

“Ether options remain concentrated in December expiration,” Magadini told CoinDesk. ”Traders are net short in December far out of the money calls. This is most likely related to beacon chain launch positioning.”

Other markets

Digital assets on the CoinDesk 20 are mostly red Friday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil was down 0.18%. Price per barrel of West Texas Intermediate crude: $40.73.

- Gold was in the red 0.46% and at $1,899 as of press time.

- U.S. Treasury bond yields all climbed Friday. Yields, which move in the opposite direction as price, were up most on the 10-year, jumping to 0.741 and in the green 0.91%.

The CoinDesk 20: The Assets That Matter Most to the Market

The CoinDesk 20: The Assets That Matter Most to the Market

Source