Bitcoin was slipping Friday on lower-than-average volumes for 2021 so far. In other news, while BTC and ETH are up this year, some DeFi tokens are doing even better.

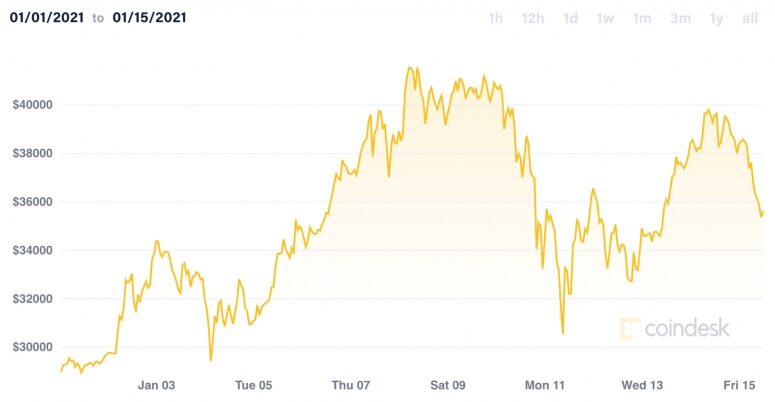

- Bitcoin (BTC) trading around $35,610 as of 21:00 UTC (4 p.m. ET). Slipping 9.4% over the previous 24 hours.

- Bitcoin’s 24-hour range: $34,425-$39,673 (CoinDesk 20)

- BTC below the 10-hour and 50-hour moving averages on the hourly chart, a bearish signal for market technicians.

Bitcoin trading on Bitstamp since Jan. 12. Source: TradingView

Bitcoin trading on Bitstamp since Jan. 12. Source: TradingView

The price of bitcoin fell Friday, a steady decline over the past 24 hours that saw the world’s oldest cryptocurrency bottom out as low as $34,425 before picking up to $35,610 as of press time.

“The price rested at $40,000. Now we are waiting for a rollback to $34,000,” said Constantin Kogan, partner at crypto investment firm Wave Financial. “Most likely the next possible low will be at least $26,000.”

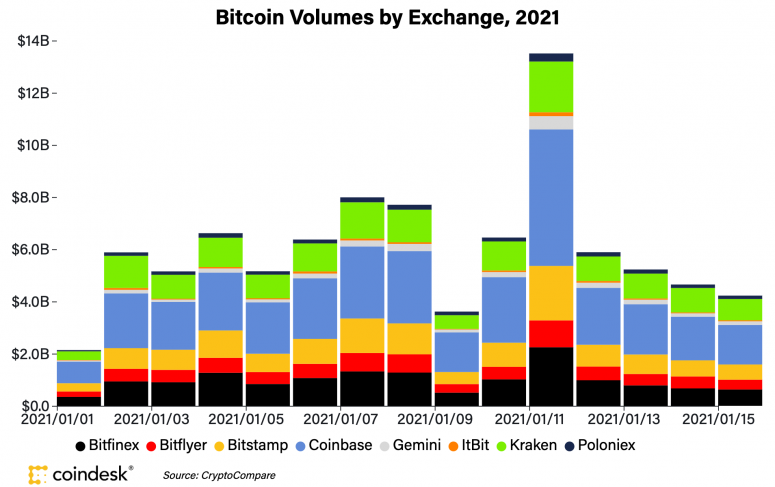

That’s a pretty bearish sentiment from an analyst, but the outsized volume numbers to open 2021 are certainly diminishing for the time being. For the first two weeks of the new year, bitcoin’s daily spot volume on the eight major exchanges tracked by CoinDesk (Bitfinex, Bitflyer, Bitstamp, Coinbase, Gemini, itBit, Kraken and Poloniex) averaged $6.1 billion per day. For Friday, spot volumes are at $4.2 billion, as of press time.

Spot volumes on major bitcoin exchanges in 2021. (Shuai Hao/CoinDesk Research) Source: CryptoCompare

Spot volumes on major bitcoin exchanges in 2021. (Shuai Hao/CoinDesk Research) Source: CryptoCompare

“There is a definite tug and pull between North American and Asian traders in crypto assets,” noted Joel Edgerton, chief operating officer of cryptocurrency exchange BitFlyer USA. “Since the U.S. is going into a three-day weekend the U.S. trading volume will be lighter, so Asia will likely set the tone.”

Many investors and traders will be off Monday for Martin Luther King Jr. Day including the U.S. equities markets, which along with other major indexes are ending the week in the red Friday.

“The important thing to keep in mind is that the macro view has not changed,” said Bitflyer’s Edgerton. “There is growing demand for crypto assets, an unwillingness of current holders to sell and limited supply being added. This naturally leads to long-term price appreciation.”

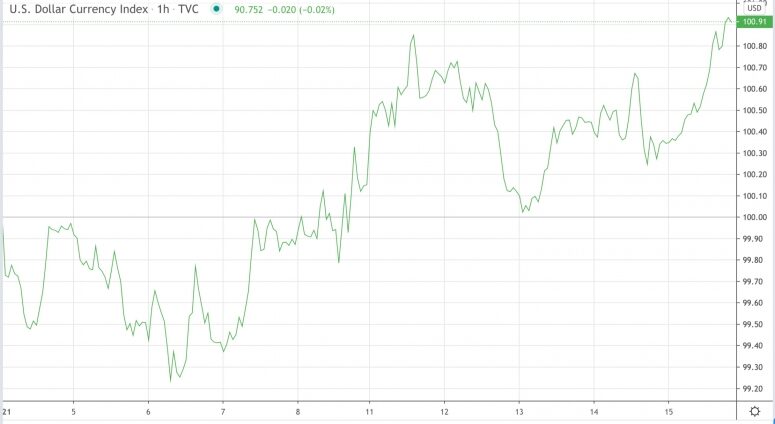

Andrew Tu, an executive of quant trading firm Efficient Frontier, pointed to the inverse relationship between the U.S. Dollar Index and bitcoin as a macro example. The index, also known as the DXY, is a measure of the greenback versus a basket of other fiat currencies.

Bitcoin’s historical price in 2021. Source: CoinDesk 20

Bitcoin’s historical price in 2021. Source: CoinDesk 20

“The rise in DXY was simultaneously accompanied by a drop in BTC,” Tu told CoinDesk. “On a fundamental level, the economy looks weak, thus probably driving a risk-off move into dollars.”

The U.S. Dollar Index in 2021. Source: TradingView

The U.S. Dollar Index in 2021. Source: TradingView

When bitcoin goes up, the DXY seems to go down and vice versa, at least so far in 2021. On Friday, the DXY was up 0.55% during bitcoin’s bearish past 24 hours.

Big-name DeFi tokens doing better than ether in 2021

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Friday, trading around $1,139 and slipping 5.7% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Bitcoin’s is up over 20% in 2021. However, ether is easily beating that, in the green over 50% to start the year. Meanwhile, two well-known projects built on the Ethereum platform used for decentralized finance (DeFi) are doing even better than that. The token associated with derivatives liquidity platform Synthetix is up more than 83% so far this year, while lending protocol Aave’s token has climbed more than 69% in 2021 so far.

Ether (dark blue), Synthetic (light blue) and Aave (yellow) spot performance on Kraken in 2021. Source: TradingView

Ether (dark blue), Synthetic (light blue) and Aave (yellow) spot performance on Kraken in 2021. Source: TradingView

Jean-Marc Bonnefous, managing partner of investment firm Tellurian Capital, told CoinDesk DeFi tokens such as aave and synthetix have big upside potential in bullish markets. He recently tweeted about DeFi token performance over the last three months. However, Bonnefous cautioned that there’s also a downside to these lesser-known and less-liquid tokens.

“Ether is the mothership, the main reserve currency layer for DeFi, whereas the DeFi coins are more application-related with a potential additional monetization component and some growth potential if well executed,” Bonnefous said. “So by nature the top DeFi assets will likely outperform in a up market for crypto in general, and conversely in a bear market.”

Other markets

Digital assets on the CoinDesk 20 are mixed, mostly in the red Friday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Oil was down 2.9%. Price per barrel of West Texas Intermediate crude: $52.12.

- Gold was in the red 1.1% and at $1,825 as of press time.

- The 10-year U.S. Treasury bond yield fell Friday, dipping to 1.092 and in the red 3.4%.

The CoinDesk 20: The Assets That Matter Most to the Market

The CoinDesk 20: The Assets That Matter Most to the Market

Source