Some bitcoin selling on Friday caused its price to decline. Ether options traders appear less inclined to place bets on the asset’s price, as evidenced by lower Deribit volume.

- Bitcoin (BTC) trading around $18,975 as of 21:15 UTC (4:15 p.m. ET). Slipping 2.1% over the previous 24 hours.

- Bitcoin’s 24-hour range: $18,717-$19,556

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

Bitcoin trading on Bitstamp since Dec. 1. Source: TradingView

Bitcoin trading on Bitstamp since Dec. 1. Source: TradingView

Bitcoin prices slipped on sell volume at around 10:00 UTC (5 a.m. ET) Friday, pushing price below the $19,000, albeit temporarily. It was up to $18,975 as of press time.

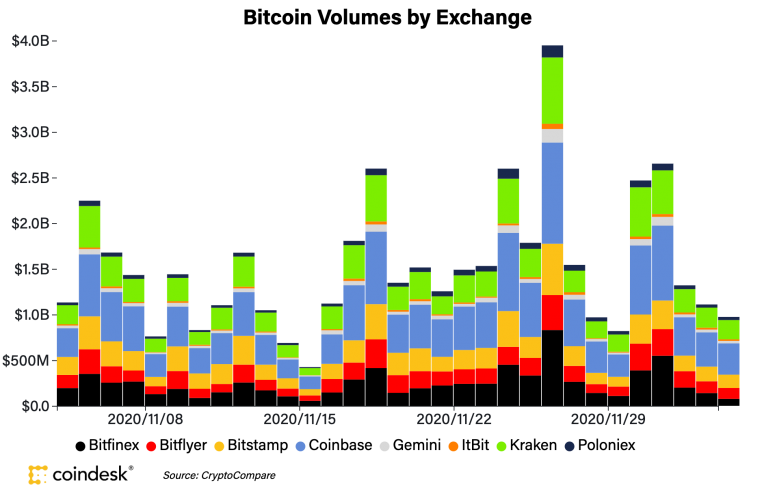

Low spot volumes on CoinDesk 20 exchanges are plaguing the market for the third day in a row, with Friday’s $973 million in daily volume as of press time lower than Thursday’s $1.1 billion in daily volume and Wednesday’s $1.3 billion in trading activity across the eight major exchanges.

Daily spot volumes across CoinDesk 20 exchanges the past month. Source: CoinDesk 20

Daily spot volumes across CoinDesk 20 exchanges the past month. Source: CoinDesk 20

However, spot trading activity often belies the impact of the institutional market, which often uses over-the-counter or quantitative strategies to scoop up bitcoin, noted Joel Edgerton, chief operating officer of cryptocurrency exchange bitFlyer. “We are watching Grayscale and PayPal continue to suck up BTC, but volumes should be lighter over the weekend as traders assess their positions,” said Edgerton. (Grayscale is a sister company to CoinDesk.)

Some tax-related profit-taking might be in store for the balance of December, added Edgerton. “We are also getting to the point where investors in the U.S. start to review their portfolios from a tax optimization point of view, which could lead to selling pressure in the U.S. over the next few weeks.”

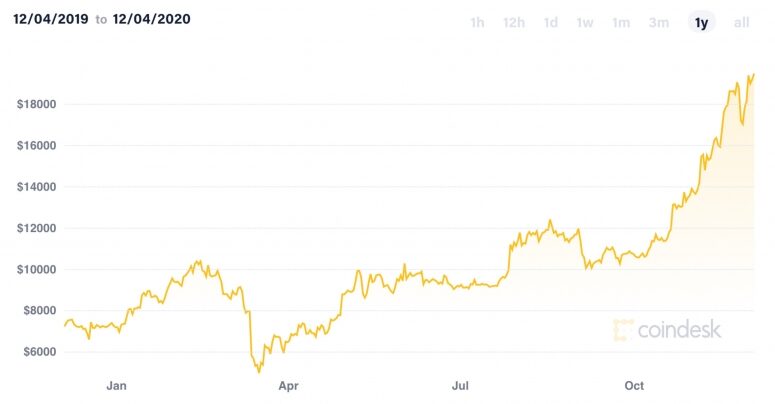

Bitcoin’s historical price over the past year. Source: CoinDesk 20

Bitcoin’s historical price over the past year. Source: CoinDesk 20

“Bitcoin has had a good run for the last two months, so a pause or even a pullback are and have been expected,” said Elie Le Rest, partner at quantitative trading firm ExoAlpha. He also suspects there will be further sell-offs as various market participants such as miners or long-term holders may look to exchange crypto for cold hard cash. “The interest is to sell in a strong market in order to reduce their negative market impact,” he said, “but as the markets look weak, they may not sell right now.”

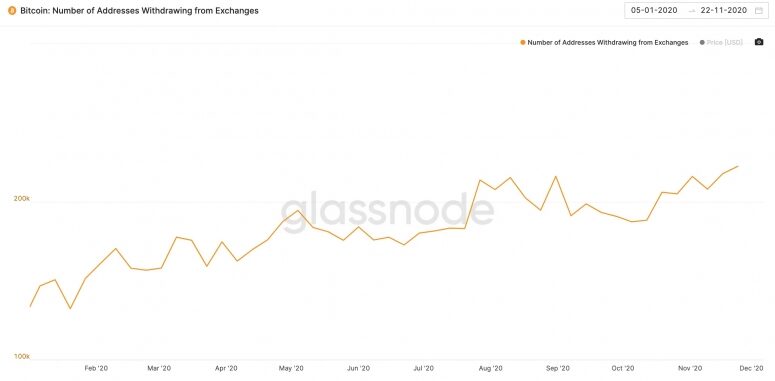

According to data from aggregator Glassnode, the number of bitcoin addresses withdrawing from exchanges is much lower than those depositing so far this year. Glassnode calculates over 200,000 separate addresses have been receivers in transactions receiving funds from exchanges in 2020.

Bitcoin addresses withdrawing from exchanges in 2020. Source: Glassnode

Bitcoin addresses withdrawing from exchanges in 2020. Source: Glassnode

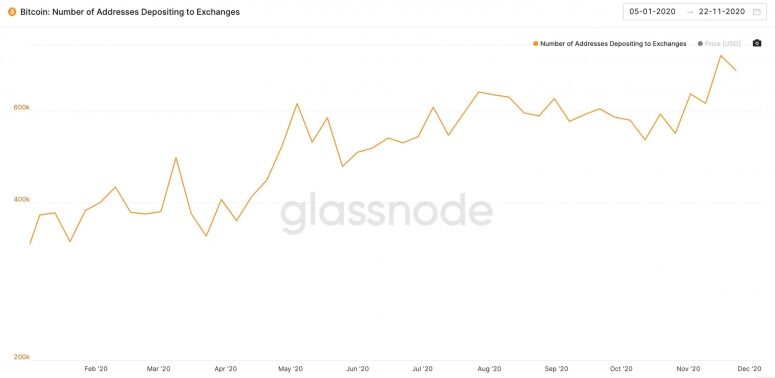

Meanwhile, over 700,000 addresses appeared as senders in transactions sending bitcoin to exchanges in 2020 so far.

Bitcoin addresses depositing to exchanges in 2020. Source: Glassnode

Bitcoin addresses depositing to exchanges in 2020. Source: Glassnode

More bitcoin is going into exchanges than coming out, at least according to Glassnode data. What traders plan to do with those balances is anyone’s guess, but ExoAlpha’s Le Rest also reiterated the potential for December profit-taking. “After a torrid bull run, a sideways or even a 15% pullback is definitely expected before a new bull run can take place.” Le Rest added.

Ether options volumes dropping

Ether (ETH), the second-largest cryptocurrency by market capitalization, was down Friday, trading around $588 and slipping 4% in 24 hours as of 21:15 UTC (4:15 p.m. ET).

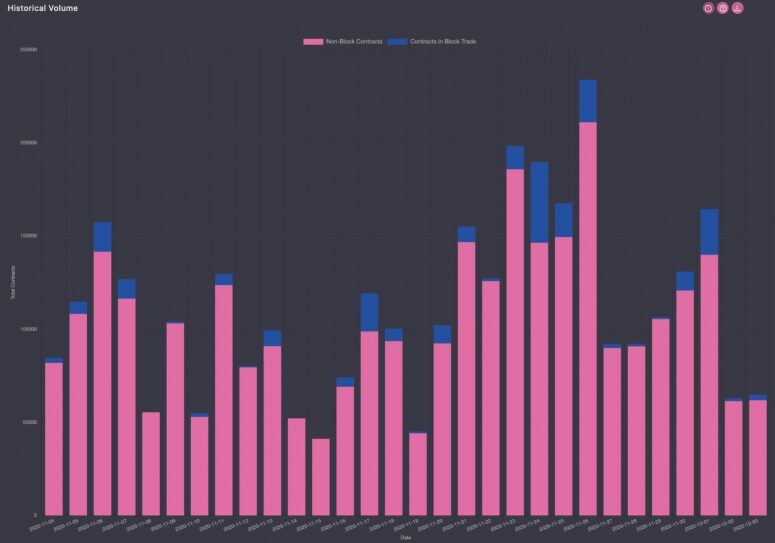

After a surge of ether options volume on derivatives venue Deribit at the end of November, market interest seems to have dissipated, according to Greg Magadini, chief executive officer for data aggregator Genesis Volatility. “Volumes are decreasing and implied volatility is dropping. There is no clear decisiveness at the moment,” Magadini told CoinDesk.

Historical ether options volume on Deribit the past month. Source: Genesis Volatility

Historical ether options volume on Deribit the past month. Source: Genesis Volatility

“Traders are taking a ‘wait and see’ approach right now in the ETH options market,” Magadini added. He noted that traders aren’t even all that interested in downside protection in the form of put options. That’s an indicator that many options traders expect ether’s price to bounce back up. “As ETH retraces below $600, no one is enthusiastic about buying puts,” he said.

Other markets

Digital assets on the CoinDesk 20 are mixed Friday, mostly red. Notable winners as of 21:15 UTC (4:15 p.m. ET):

- Oil was up 0.90%. Price per barrel of West Texas Intermediate crude: $46.03.

- Gold was in the red 0.19% and at $1,836 as of press time.

- The 10-year U.S. Treasury bond yield climbed Friday jumping to 0.969 and in the green 6.5%.

Source