Bitcoin (BTC) was trading around $9,575 as of 20:00 UTC (4 p.m. ET), gaining less than a percent over the previous 24 hours.

After Tuesday’s rapid 8% drop in less than five minutes on high sell volume, bitcoin’s prices have steadied. At 00:00 UTC on Wednesday, the world’s largest cryptocurrency by market capitalization was changing hands around $9,528 on spot exchanges like Coinbase. Ten hours later, it staged a small run-up to $9,650 yet low trading volumes dashed any hopes of a substantial rally. Bitcoin is below its 50-day moving averages, signaling a technical sideways bearish sentiment.

Bitcoin trading on Coinbase since June 1 Source: TradingView

Bitcoin trading on Coinbase since June 1 Source: TradingView

After an exciting start to a week where bitcoin surged quickly then dropped, traders certainly have strong opinions on recent market activity

Rupert Douglas, head of institutional sales at brokerage Koine, believes that the movement’s intention was to wipe out some traders in the derivatives market. “My take is that this sharp rejection is a shakeout of the weak longs,” said Douglas.

Global equities

After the cryptocurrency excitement over the past few days, stock markets across the globe are taking center stage, as all major indices are doing well.

Japan’s Nikkei 225 closed its day up 1.6%, led by increased demand in the automotive sector within Asia. The FTSE Eurotop 100 index of the largest stocks by market capitalization ended trading in the green 2.6% as the Eurozone eases lockdowns.

In the United States, the S&P 500 index was 1.3%, up over 2% so far in June on optimism as businesses begin to reopen amid a global pandemic.

“Equities are approaching levels that I think we will see at least a pullback from and I expect that weakness in equities will see strength in bitcoin,” said Koine’s Douglas.

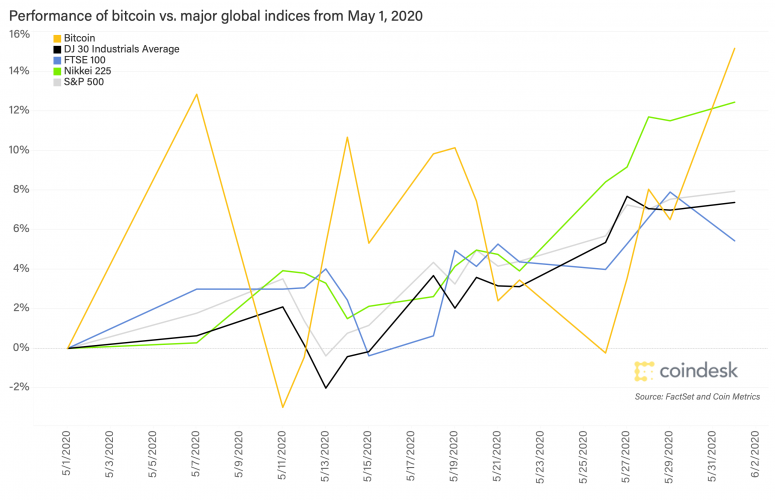

Such a situation would only make bitcoin’s recent performance look even better comparatively. Although not exactly a smooth ride, since the start of May, bitcoin is up over 14%, outperforming all the major stock indices. Only the Nikkei 225 is exceeding 10% in the green during the same time, according to data compiled by CoinDesk Research.

Bitcoin versus global indices since 5/1/2020 Source: CoinDesk Research

Bitcoin versus global indices since 5/1/2020 Source: CoinDesk Research

A quiet day for bitcoin might just be the platform for another price breakout, said Henrik Kugelberg, an over-the-counter cryptocurrency trader based in Sweden.“I have had massive signals of an imminent surge in bitcoin the last couple of days”.

Deal flow seems to be skewed towards traders hitting up desks for more crypto during the bitcoin lull Wednesday, Kugelberg told CoinDesk. “Many are buying, and sellers are much more scarce now,” he said.

“My network is split,” said Mostafa Al-Mashita, an executive at digital asset liquidity provider Secure Digital Markets. “Some people are calling for $7,000 bitcoin and others are bullish for $11,000.”

Other markets

Digital assets on CoinDesk’s big board are in the green Wednesday. The second largest cryptocurrency by market capitalization, ether (ETH), the second largest cryptocurrency by market capitalization, climbed 2% in 24 hours as of 20:00 UTC (4:00 p.m. EDT).

Ether trading on Coinbase since June 1 Source: TradingView

Ether trading on Coinbase since June 1 Source: TradingView

Cryptocurrency winners on the day include cardano (ADA) in the green 8%, nem (XEM) climbing 6.7% and iota (IOTA) up 6%. The lone loser Wednesday is bitcoin SV (BSV), down 2%. All price changes were as of 20:00 UTC (4:00 p.m. EDT).

In commodities, gold is in the red, with the yellow metal losing 1.5% and closing at $1,697 at the end of New York trading.

Contracts-for-difference on gold since June 1 Source: TradingView

Contracts-for-difference on gold since June 1 Source: TradingView

Oil is flat on the day, slipping less than a percent as a barrel of crude is priced at $36.74 as of press time.

U.S. Treasury bonds climbed Wednesday. Yields, which move in the opposite direction as price, were up most on the 2-year, in the green 11%.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Source