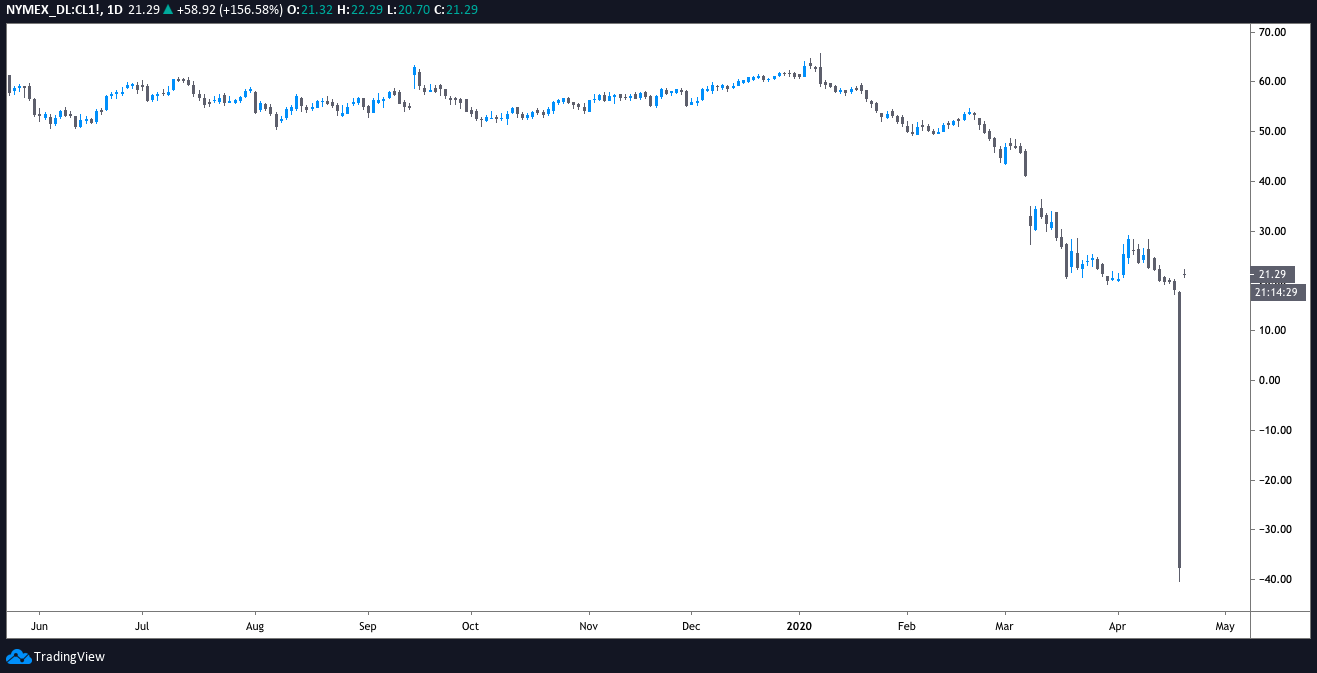

As reported earlier by Cointelegraph, the May 2020 Futures contract for West Texas Intermediate (WTI) Crude dropped more than 100% on Monday. At its worst the price reached negative $37.63, a phenomenon which has never occurred before.

WTI May futures (CL1). Source: TradingView

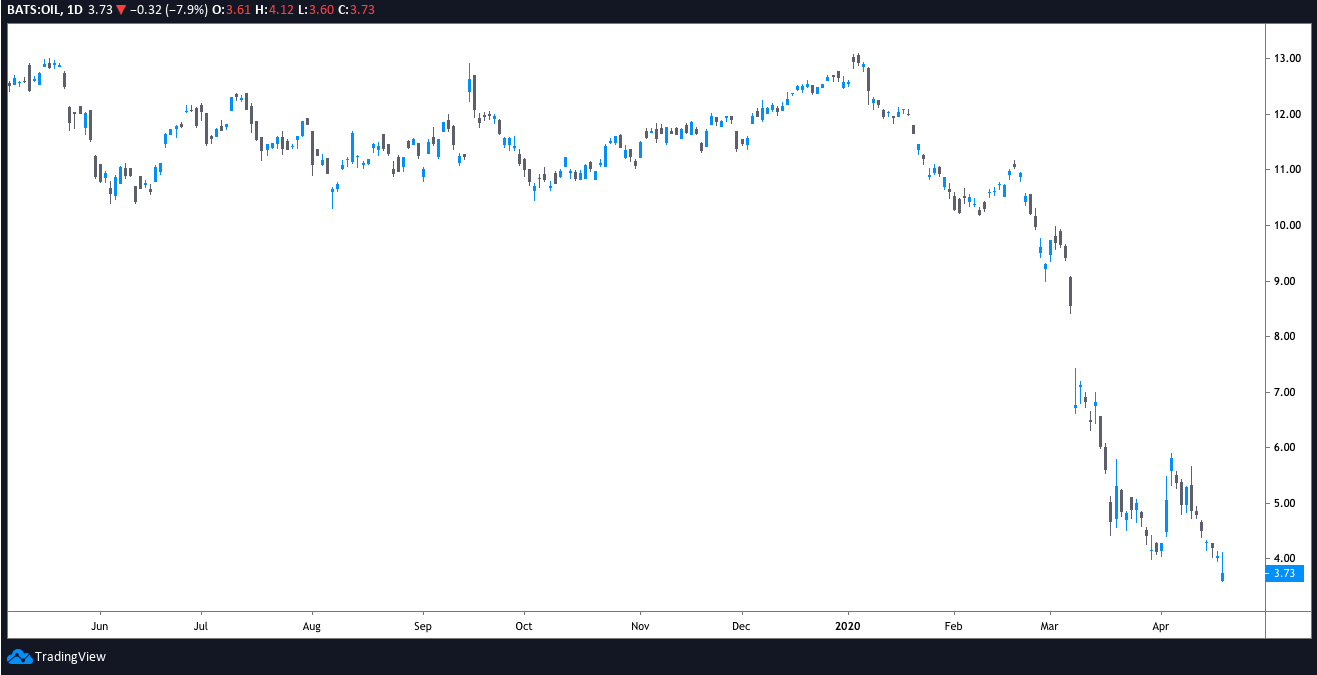

The June WTI contract with a May 19 expiry date also dropped nearly 20% to $20.43 per barrel and Barclays IPATH ETN (OIL) fell to $3.50.

OIL drops to $3.50. Source: TradingView

Less than a month ago, OPEC and Russia ended their oil war by agreeing to cut production by 9.7 million barrels per day on May 1 but at this point any confidence inspired by the deal has likely evaporated.

The precipitous drop shows that the global economy remains in fragile shape despite the strong rebound seen in the Dow and S&P 500 in the last 3 weeks. The price collapse in oil futures also highlights the impact the coronavirus pandemic has had on global demand for oil as everything from the airline industry, shipping, and construction projects have essentially come to a standstill.

The situation is further exacerbated by producers across the globe who continue to pump and fears that traders have limited access to storage for the oversupply. Even more worrisome is the spread between May and June contracts and some analysts suggest this can be interpreted as a bearish signal as traders fear they will not find a place to deliver physical crude in the future.

While today’s collapse in WTI futures is shocking and unprecedented, the June WTI contract and Brent crude remain above $20. Meanwhile traditional markets closed in the red on Monday but after hours the Dow and S&P 500 futures have turned positive, gaining 0.52% and 0.58% respectively.

What about Bitcoin?

BTC USDT daily chart. Source: TradingView

Bitcoin (BTC) price also corrected 4.23% as WTI futures imploded and at the time of writing the cryptocurrency trades for $6,820. As the decline in oil prices kicked off, Bitcoin price dropped below the $7,200 support after failing to overcome the $7,277 resistance over the weekend.

After losing the $7,000 handle, the price fell through a more critical support at $6,850 and currently traders are fighting to hold the price above this level. A drop below the high volume VPVR node at $6,850-$6,625 opens the door for the price to revisit $6,300.

The collapse in oil prices and relative stability in Bitcoin price set crypto Twitter a fire with memes and statements comparing the Federal Reserve’s current quantitative easing policy to OPEC’s plan to continue pumping oil even though this is a significant oversupply and limited demand at the moment.

Many crypto advocates were also quick to point out that Bitcoin’s capped supply provides it with a unique advantage when compared to the limitless printing of the U.S. dollar and the unending extraction of oil.