Bitcoin miners generated an estimated $522 million in revenue in November, up 48% from October, according to on-chain data from Coin Metrics analyzed by CoinDesk.

The sharp revenue increase came as bitcoin soared through November, setting a new all-time high by month’s end after gaining over 40 percent. Monthly aggregate revenue in November hit the highest level since September 2019.

Revenue estimates assume miners sell their BTC immediately.

Measured by revenue per terahash (TH), the unit measurement for the speed of cryptocurrency mining hardware, miner revenue hit six-month highs as it climbed above $0.15 multiple times in November, the highest level since early May, according to data aggregated by mining software company Luxor Technologies.

Despite significant intra-year volatility, mining revenue measured by terahash per second (TH/s) is roughly flat year to date from roughly $0.138 per TH/s on Jan 1 to $0.135 per TH/s at last check.

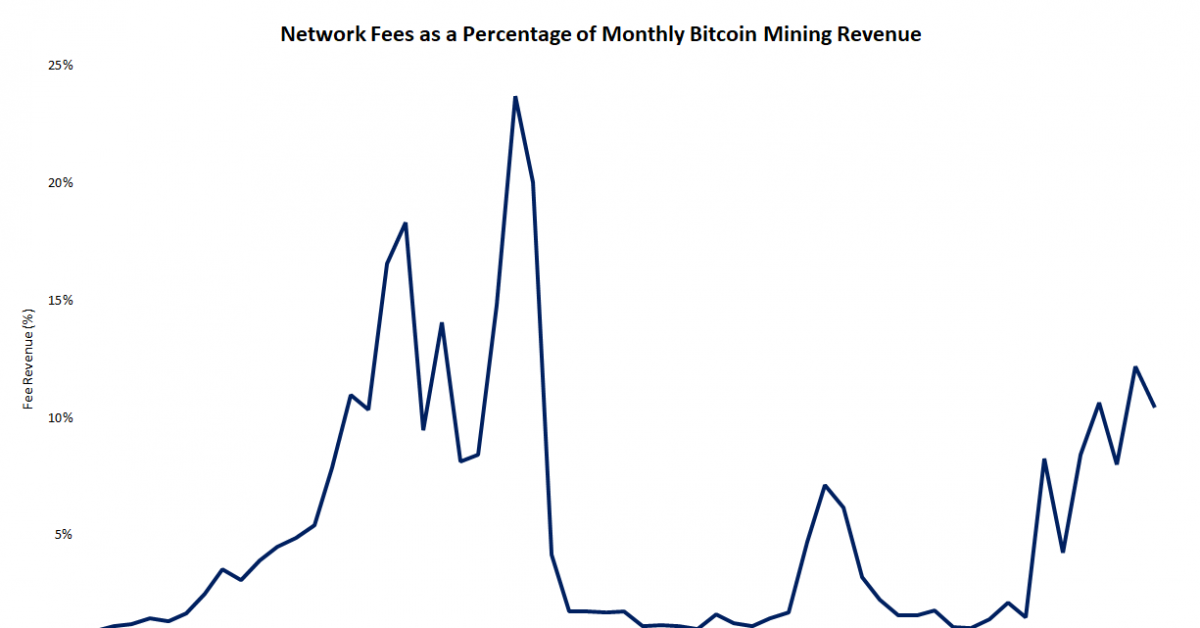

Network fees brought in $54.9 million in November, or nearly 11% total revenue, a slight percentage decrease from the 12.2% of revenue represented by fees in October.

Fees steadily declined through November, coming down from the roughly two-year highs in late October, dropping from a $13 average transaction fee at the start of November to below $3 near month’s end, per Coin Metrics.

Notably, fees as a percentage of total revenue continues a strong upward trend since April, prior to the network’s third-ever block subsidy halving in May. Increases in fee revenue are important to sustain the network’s security as the subsidy decreases every four years.

Taking advantage of the revenue increase, miners are bringing more and more machines online after early November’s record difficulty drop, with the past two adjustments resulting in difficulty increases and a third consecutive increase projected for mid December, meaning an increase in resources required to mine than at a lower difficulty level.

Source