Bitcoin is in consolidation mode after one of its largest quarterly gains on record. All signs suggest that there’s still more upside left in this bull run, but according to a fractal found during the last major market cycle, a sudden sweep of lows is possible before bulls regain control.

Here’s what to expect for price action if this ultimately bullish fractal is a valid roadmap of what’s to come.

Be Ready To Buy The Dip If Fractal Forming Is Accurate

Bitcoin price is still trading $10,000 below its highest peak in 2021, yet since last night’s daily close bulls have suddenly begun to make a comeback.

But before new highs are set, a sudden and sharp sweep of lows could clear out long positions taken over the last several weeks. The warning stems from a fractal found during Bitcoin’s last major bull run, in 2017.

Related Reading | A Dangerous Technical Pattern In Bitcoin Is Back, And It Is Breaking Down

The shakeout move arrived after a new all-time high was set and long in the rear view, just like the current setup. It also proceeded the historic rally from under $2,000 to nearly $20,000 per coin.

A similar response after the lows are swept, would take the price per BTC to as high as $200,000 – meaning that this is potentially the most lucrative “dip” to buy before the next peak and bear market.

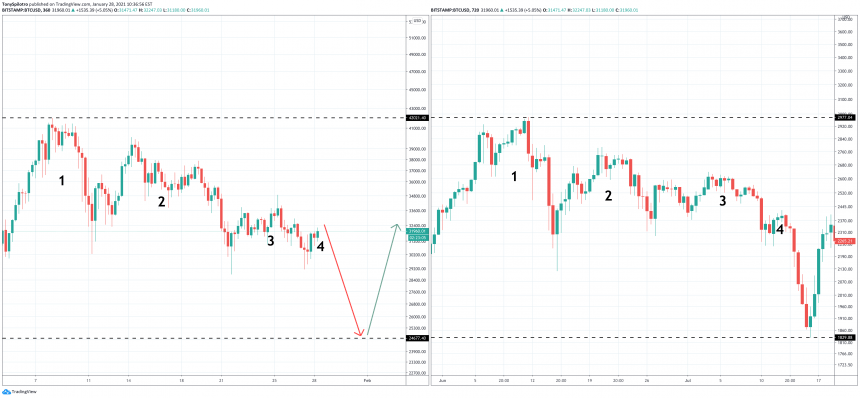

Visually, the price action is strikingly similar | Source: BTCUSD on TradingView.com

Comparing The Bitcoin Fractal Before “The Point Of No Return”

Comparing the fractal with current price action side by side, the similarities are easily visible. A large, sharper peak starts the downward price action, and subsequent peaks form each decreasing in size. After the fourth attempt, bears pull out the heavy artillery and push price action down through support.

The move would clear the market of over-eager traders that got into position too soon, taking advantage of the exuberance in the market.

Related Reading | Evening Star: Reversal Pattern Could Sunset Bitcoin Price Action For Weeks

And just as sentiment turns to extreme fear, leaving investors wondering how deep the violent drop will go, a V-shaped recovery takes Bitcoin to only one more major correction before the “top” of the cycle is in and bear market starts.

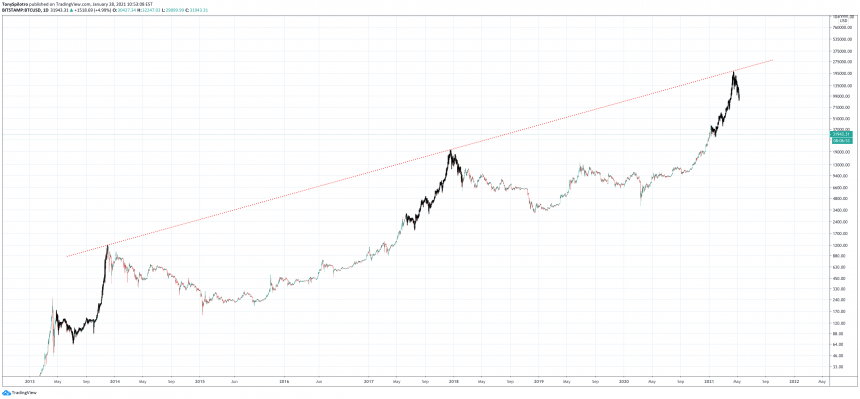

The fractal seems to appear at the “point of no return” for Bitcoin, right before the final push to the peak. The most direct-matching fractal is found during the 2017 rally, but even the 2013 mid-point matches the pattern, albeit a far more volatile structure.

Is this the last major shakeout before $200K BTC? | Source: BTCUSD on TradingView.com

If the volatility in each of these patterns gets lessened each time, this latest instance of the fractal might not produce such violent results.

Whatever the case may be, buying the dip wherever the bottom of this current correction is, could produce life-changing wealth.

Featured image from Deposit Photos, Charts from TradingView.com

Source