Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Buy the Dip

Buy the Dip

Bitcoin price tumbles, falling below $17,000 in biggest crash since March

At the start of the week, the crypto markets were brimming with optimism. Bitcoin was one resistance zone away from all-time highs, altcoins were rallying by triple digits, and the surge was making a splash on the homepage of The Wall Street Journal.

With Bitcoin’s market cap at all-time highs, it was time to celebrate with a nice turkey dinner and all the trimmings. Unfortunately, Thanksgiving left the crypto world with a rather bitter aftertaste.

On Nov. 26, BTC’s price suffered one of its biggest dollar losses since March. All told, the world’s biggest cryptocurrency collapsed by more than 15%. Massive liquidations were blamed for the crash from $19,484 to $16,334 in the space of a day.

As Cointelegraph analyst Michaël van de Poppe noted, market corrections are rarely elegant things. “They are often vertical and painful. Staircase up, elevator down,” he wrote.

Three reasons traders now expect Bitcoin hitting $13,000 before a new rally

So… what happens next? Are hopes of hitting $20,000 dashed in the short term, or was this a mere blip in the road that should be shrugged off?

Well, it depends very much on who you ask. Some traders are anticipating another steep pullback in the not-too-distant future, pointing to historical patterns that suggest BTC could fall back down to the $13,800–$14,500 range.

A pseudonymous trader known as “Salsa Tekila” said BTC needed to break $17,500 to remain in bullish territory, adding that $18,700 is the only big resistance before all-time highs. However, the trader warned that things are looking bearish below $17,500… and this could prompt a drop to the $11,000–$13,000 range.

Others, such as the crypto index fund provider Stack Funds, have described the pullback as a “healthy correction” that was needed before Bitcoin continues its upward trajectory.

The firm said BTC has been at overbought levels since October, meaning some heat desperately needed to leave the market.

Meanwhile, Quantum Economics founder Mati Greenspan said the correction may have already bottomed out, adding: “A 17% pullback is rather tame for this stage of the cycle.”

Ethereum 2.0 confirmed for Dec. 1 launch, just hours before deadline

Eth2’s beacon chain has been confirmed for Dec. 1 after 16,834 validators transferred 524,288 ETH into a deposit contract.

There had been doubts over whether the deposit contract would hit the minimum threshold by Nov. 24, paving the way for Phase 0 to begin in earnest a week later.

But transfers rapidly increased as the deadline neared. There was a celebratory atmosphere in the ETH community, not least because it finally marks the beginning of an upgrade that has been plagued by delays and complications.

While genesis participants will not be able to withdraw their coins until Eth2 reaches Phase 1.5 — which will merge the Ethereum mainnet with Eth2’s beacon chain and sharded environment — many hodlers are waiting for third parties to launch withdrawal-enabled staking services, despite the potential risk of exit scams.

Yearn Finance is going on an acquisition spree

Away from the major cryptocurrencies, Yearn Finance has had a very busy week. In a sign that consolidation is coming to the DeFi markets, the protocol has performed three high-profile mergers in as many days.

On Nov. 25, Yearn Finance announced a partnership with Pickle Finance to boost yield farming incentives. It’s also hoped that the move will compensate those affected when $20 million was lost in a recent Pickle exploit.

A day later, YFI was yearning for more. The protocol’s founder, Andre Cronje, announced details of yet another integration. This time, Yearn planned to join forces with Cream, a lending protocol similar to Compound and Aave.

But the acquisition spree was far from over. On Saturday, a new collaboration was also unveiled with the market coverage provider Cover.

Observers say Yearn is “scooping up developers and monopolizing talent,” but critics have claimed that none of these acquisitions have actually been approved through a community vote.

Facebook’s Libra to reportedly launch in January 2021 as USD stablecoin

After months of uncertainty and regulatory drama, Facebook’s embattled Libra project might be nearing launch at last… kind of.

Reports suggest that Libra will initially take the form of a U.S.-dollar-backed digital currency — and it could see the light of day as soon as January 2021.

According to the Financial Times, the Libra Association will eventually add more fiat currencies to the basket of assets that back Libra’s value.

The exact launch date is still unknown and would depend on the Libra Association receiving approval from regulators in Switzerland to operate as a payments service.

Winners and Losers

Winners and losers

Winners and losers

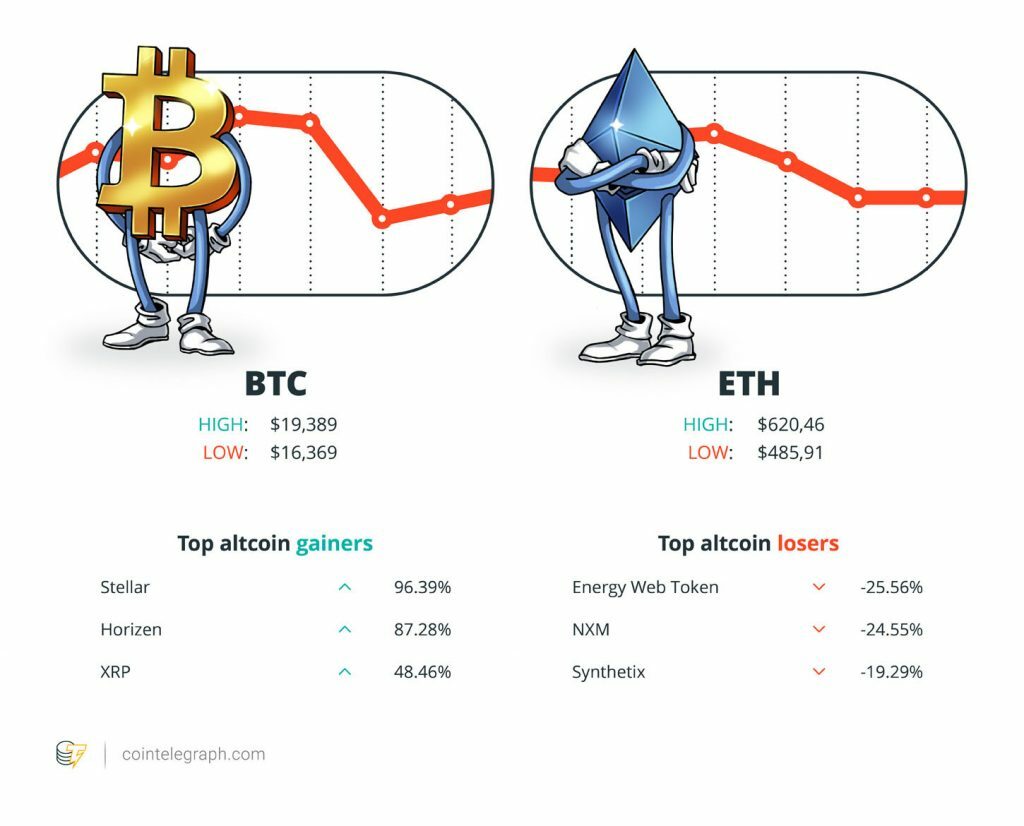

At the end of the week, Bitcoin is at $17,707.60, Ether at $541.01 and XRP at $0.62. The total market cap is at $530,787,776,807.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Stellar, Horizen and XRP. The top three altcoin losers of the week are Energy Web Token, NXM and Synthetix.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“It’s quite common that market corrections don’t happen in a smooth manner. They are often vertical and painful. Staircase up, elevator down.”

Michaël van de Poppe, Cointelegraph analyst

“#Bitcoin has been compared negatively to a lot of things over the years, such as tulips, rat poison, Ponzi schemes, snake oil, etc., but the one that has hurt the most by far has been the comparison to the Segway.”

Tyler Winklevoss, Gemini co-founder and CEO

“The New York Times is planning to publish a negative story about Coinbase […] The story will likely imply that Black employees were discriminated against during this process; this is false.”

Coinbase

“Everyone should put 2% to 3% of their net worth in Bitcoin and look at it in five years, and it’s going to be a whole lot more.”

Mike Novogratz, Galaxy Digital founder and CEO

“WHAT CRAP — new to coinbase — and all my XRP trades went into limbo then finally showed up only AFTER the bottom fell out — causing me to lose a ton of money!!!”

Mike Palagi, Coinbase user

Prediction of the Week

Institutional money may propel Bitcoin to $250,000 in a year, says macro investor

Global Macro Investor CEO Raoul Pal has predicted that Bitcoin could hit $150,000 by November 2021 in the most conservative scenario — and could even surge to $250,000 owing to the large amount of institutional money currently flowing into the market.

According to Pal, most of Bitcoin’s additional supply is currently being absorbed by PayPal, Square and Grayscale. He believes that the resulting supply squeeze is the catalyst for Bitcoin’s latest surge.

“I’ve never seen a market with this supply and demand imbalance before,” Pal said, pointing out the macroeconomic factors that are playing in Bitcoin’s favor.

Pal went on to predict that additional monetary stimulus to sustain economies in the wake of COVID-19 will devalue fiat, and this, together with low interest rates, will propel Bitcoin’s price to new highs.

“It’s life-changing. No other asset has an upside of 5x, 10x, 20x in a short space of time,” he told Cointelegraph.

FUD of the Week

XRP price spikes to $0.90, crashes in seconds as Coinbase goes down

Altcoins weren’t immune from the Bitcoin bloodbath, and it was red across the board in the immediate aftermath of the nightmare before Thanksgiving.

But just before this correction happened, something crazy was happening with XRP.

The No. 3 cryptocurrency, not known for being a digital asset that delivers big gains, has had a blockbuster November. At the time of writing, it’s risen 154% since the month began — rallying from $0.24 to $0.61. Most of these gains were concentrated over a few days.

At one point this week, XRP hit highs of $0.76, but over on Coinbase, it briefly spiked to $0.90 before crashing back down by 30% in a matter of seconds. This was the highest price level since May 2018.

The rally was apparently driven by Coinbase users as the price of XRP did not see the same heights on other exchanges.

Some disgruntled traders flocked to Downtector and claimed they had lost “a ton of money” after their trades failed to process.

PayPal suspends user for crypto trading using PayPal’s own service

Well this is awkward. A PayPal user has claimed their account was restricted… because they were performing too many trades on the platform’s new crypto service.

On Reddit, the user in question claimed that PayPal had sent them a message, informing them that their account was being permanently limited “due to potential risk.” But “TheCoolDoc” claimed they had only made 10 crypto transactions over a week — purchasing during dips and selling when prices were high.

Bizarrely, PayPal had asked for an explanation for each transaction. Hours later, the user was told they would not be able to conduct any further business using the platform — and the funds in their account were placed on a 180-day hold.

Other Reddit users pointed out that the service is supposed to be more of a Bitcoin bank account than a trading account. Nonetheless, TheCoolDoc has vowed that they will “never buy a Satoshi of crypto” from PayPal again.

Chinese police seized crypto assets worth $4.2 billion today from PlusToken Ponzi

The PlusToken scandal has reportedly resulted in a titanic seizure of crypto assets by Chinese authorities — worth $4.2 billion at today’s prices.

Court rulings posted by The Block show authorities have seized 194,775 BTC and 883,083 ETH — alongside millions of Litecoin, Dogecoin and XRP.

Gains from the seized crypto assets will be forfeited to the national treasury. The precise details of how the assets will be dealt with and processed in accordance with national laws have not been fully spelled out.

The PlusToken scheme had presented itself as a South Korean crypto platform that could generate 8%–16% returns per month, drawing in 2 million members. It later turned out to be one of the industry’s biggest-ever exit scams.

Best Cointelegraph Features

Hodl or spend? Retailers offer Black Friday deals for those paying with cryptocurrency

As crypto enters the mainstream, major retailers are offering discounts and promotions to get customers to pay using cryptocurrency.

Bitcoin and blockchain topics to discuss with the crypto curious this Thanksgiving

Experts explain how to address common questions newcomers may have regarding Bitcoin and the blockchain space over the holidays.

Ethereum 2.0 to boost DeFi but delayed launch may set the network back

The launch of Ethereum 2.0 is bound to support DeFi growth, but would it be capable of handling the pace at which DeFi is growing?

Source