One of the biggest growth areas in cryptocurrency in recent years has been the introduction of Initial Coin Offerings (ICOs). But what is in an ICO? How do they work? and what options are available to us as investors?

In short, an ICO is a crowd sourcing mechanism that allows start-up business’s to raise funds by selling a token in exchange for existing cryptocurrency. This is most commonly in the form of the unit currency the blockchain start-up is built upon. For example Ether on the Ethereum network.

An ICO allows investors to fund the development of a crypto company from its very initial stage. By purchasing a token, investors are gambling on the possibility of the investment ballooning once the project has matured or for short term investors, when it initially hits an exchange.

Using the Ethereum blockchain as an example, prospective businesses are able to build their own transactable currency in the form of an ERC20 token. This can be distributed across the Ethereum network as a replacement to Ether. At the initial ICO stage, stakeholders are able to buy tokens in the hope that their early acquisition will eventually achieve an increase in value.

Whilst the token is not a share within the company, it should form an integral part of how the project operates. How well a business plans to implement a tokenised system within their business model and thus give it value, can often be a determining factor of the success or failure of a project.

In Q1 of 2018 80% of all active ICOs were launched as ERC-20 tokens on the Ethereum blockchain, confirming it as the market leader and industry standard. Other popular blockchain platforms include Neo, Stratis, Lisk, EOS and Waves. What all of these have in common is that each application allows tokens to be transacted across their blockchain through use of a smart contract.

What is a Smart Contract?

A smart contract is a way of exchanging data between two parties digitally without the need of an intermediary. It operates automatically to pre-set rules based on the terms set by the agreement when the contract was created. In its simplest definition, a smart contract is a form of decentralized automation that allows a transaction of value to take place in a transparent, undisputable form; without the need of a middle man.

The benefits of smart contracts over traditional contracts are obvious. By using a blockchain based system benefits come from improved accuracy, speed, transparency and security. Transaction and labour expenses are massively reduced as is the risk of human error. The concept has the ability to revolutionise the way businesses operate, transforming legal industries , supply chain management, healthcare and banking sectors to name but a few.

An example of how a smart contract can be seen working within an ICO is seen when a project hits its crowd sale target. At this point the amount raised is automatically issued to the company and the crowd sale ends according to the conditions set by the ICO. Anything sent above this amount is then automatically returned back to the investors in accordance with the predefined parameters of that contract.

We explore smart contracts in more detail in a future article

ICO Crowd sales, White lists & Distribution

Following an initial marketing campaign, an ICO will then allow investors to purchase tokens at a scheduled crowd sale. For private investors, tokens can often be purchased in larger quantities with undisclosed bonuses before they are made available to the public. It is important to note, private investors can often receive a hefty discount from the general sale price.

The first stage available to public investors is an ICOs presale. At this stage early investors are able to buy into a project before the main sale begins, this often includes a small bonus, however is completely dependent on the conditions set by the ICO. – Not all are formatted in this way, but most follow a similar pattern.

The main sale is generally where the bulk of contributions take place. At this point an ICO has a specified target to raise within a certain time frame. However, it is not uncommon for some ICOs to sell out a presale, or in some rare cases completely sell out at private sale. Crowd sales can last several months, or in other situations sell out in a matter of minutes depending on the interest surrounding the project and the size of the fundraising goal (hard cap). In cases where demand is high, an ICO may also choose to implement a whitelisting process and set public contribution limits to manage the quality and size of participation.

A whitelist requires those interested in the ICO to register in advance to participate. It is often the case that investors may need to provide official documents and identification to pass KYC (Know your customer). In some unique cases it may even be required to pass a series of questions in the form of an exam (take Seel or Quarkchain as recent examples). Other projects in the past have used lotteries (Neon Exchange) to randomly select applicants and occasionally some opt for use the notably unpopular Dutch auction method (Raiden Network, GEMS ICO).

Shortly after the token sale has ended, investors are then distributed their tokens during what is known as a token generation event. Tokens are sent to contributors specified wallet (not an exchange), which then, once unlocked can be traded on cryptocurrency exchanges, sometimes at a higher price than purchased during ICO stage, sometimes at a loss.

Recent ICO growth

In the last few years the popularity of ICOs has exploded within the blockchain industry. The diversity and ease of creating an ICO has given the ability for start-up businesses to crowdsource more effectively than ever before.

Whilst the past 2 years have given birth to a vast array of outstanding blockchain based projects, it is the unfortunate case that many ICOs are launched without any justified use for their token, often without a working project and in many cases have turned out to be scams from the start. For further reading simply Google ‘PlexCoin’, ‘Confido’ or ‘Pincoin’ to find notorious examples.

If losing money through a scam wasn’t bad enough, since January 2017, out of the 4000 ICO projects that have been created, a staggering 56% percent have died within just four months. Whilst this is definitely not the case for all initial coin offerings, this statistic is definitely something to bear in mind as an investor considering venturing into this field.

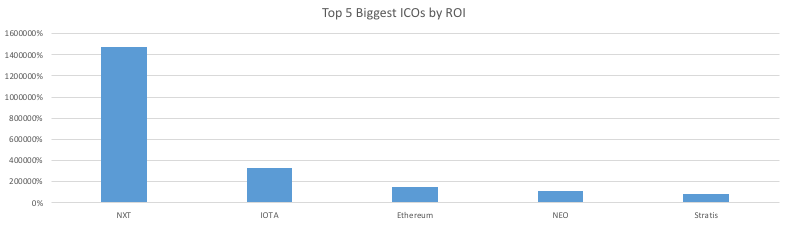

It is no secret that the precarious nature of ICO investing is something that has received negative press in the cryptocurrency industry. Contrary to what may be read, there are some incredible success stories. Throughout the last few years there have been many outstanding return on investments from companies that originally started out as ICOs. You only need to look at Neo (Formally Antshares) , NXT, Ethereum or IOTA to understand that multipliers in the regions of 200x is a possibility for those investing in the right projects. Whilst high risk, those who use the correct amount of due diligence and spend time researching projects in depth, have a real ability to make a success of this marketplace.

Some great examples of recent successful ICOs built on Ethereum are as follows:

- 0x (ZRX) +1966% ROI since ICO

- OmiseGo (OMG) +2668% ROI since ICO

- Augur (REP) +4563% ROI since ICO

- Golem (GNT) +2547% ROI since ICO

What we must stress is that before making an investment in any ICO, it is important to use the correct level of due diligence and research.

In the next article we look at red flags to avoid when investing in ICOs and how to avoid being swindled… Coming soon.