It was only a matter of time before crypto adapted elements of the $341 trillion interest rate swap market to its own. Traders may now be able to hedge the risks they face from interest rate payment fluctuations in perpetual contracts. And it could also help those lending and borrowing in the decentralized finance (DeFi) space.

On June 9, the Singapore-based Delta Exchange launched interest rate swaps (IRS) – a contractual agreement between two parties to exchange interest rate payments over a set period of time.

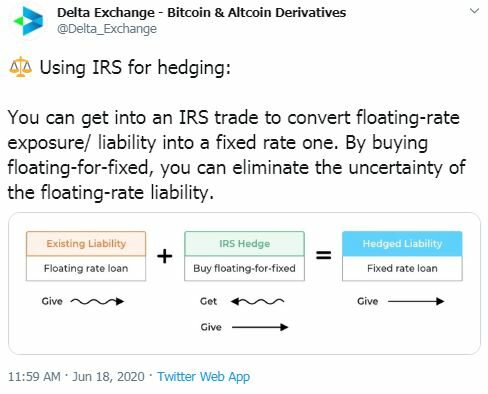

Usually, an IRS involves the exchange of floating rate and fixed-rate obligations (the parties do not exchange the principal amount). A floating interest rate is the one that moves up and down with the reference rate.

In traditional finance, an interbank interest rate like Libor often serves as a reference rate in a swap. Delta’s interest rate swaps offer floating to fixed swaps using cryptocurrency exchange BitMEX’s bitcoin perpetual (XBT/USD) funding rate as the reference, which helps tether the price of the contract to bitcoin’s spot price.

The funding rate is positive when the perpetuals trade at a premium to the spot price, indicating stronger buying pressure. In that case, longs pay funding to shorts. On the other hand, when perpetuals trade at a discount to the spot market, the funding rate is negative and shorts pay funding to longs. Funding occurs every eight hours at 04:00 UTC, 12:00 UTC and 20:00 UTC, and traders receive funding only if they hold positions at one of these times.

The BitMEX funding rate is usually positive and tends to hover in the 15%-20% range in anualized terms. However, it does rise or fall sharply during bouts of sudden price rally or crash.

A significant chunk of a trader’s profit can evaporate due to fluctuations in the funding rate if a position is held for a long time. That risk could be hedged with the interest rate swaps.

Assuming the funding rate is positive, a trader holding a long position on BitMEX can turn his floating funding rate liability into fixed cost by buying a floating-for-fixed contract for the same notional size as the XBT/USD position. Essentially, the trader would pay the fixed rate and receive the floating rate. Meanwhile, traders with a short position on BitMEX can sell floating-for-fixed contracts.

If the funding rate turns negative, the direction of floating payments will reverse, but the hedge will stay intact, according to the official blog.

Speculation

Pankaj Balani, CEO and founder of Delta Exchange said, “IRS is also for traders who do not have any exposure to these rates but just want to speculate on rates rising or falling over time.”

A speculator can buy a floating-for-fixed contract if interest rates are expected to rise over a specific period of time. “The trade will be profitable if the realized value of floating rate is higher than the expected value baked into the fixed rate,” according to Delta Exchange.

The exchange collects fixed payments up front at the trade inception, and disburses floating (funding) payments every eight hours (4 a.m. UTC, 12 p.m. UTC and 8 p.m. UTC), in sync with funding exchanges on BitMex.

“Delta has registered a notional volume of $2 million since inception,” Balani told CoinDesk. Activity could continue to rise with the increase in the institutional participation in the crypto markets.

Indeed, in traditional finance, interest rate derivatives are the largest traded contracts on organized exchanges as well as in the over-the-counter markets globally. For the second half of 2019, the notional amount of interest rate swaps globally was over $342 trillion and valued at nearly $7.5 trillion, according to data compiled by the Bank of International Settlements.

Swaps for DeFi

Besides traders and speculators, interest rate swaps may find a market with those involved in decentralized finance (DeFi).

“IRS on Delta Exchange will be super helpful for crypto companies that borrow stablecoins from lending protocols like Compound Finance and MakerDAO by keeping ether as collateral,” said Balani.

Interest rates in the DeFi space are determined by the interaction between demand and supply forces, and are quite volatile.

For instance, yields on the stablecoin tether (USDT) offered by Compound surged earlier this week following the impressive debut of the protocol’s new COMP token. Notably, interest on USDT loans rose above 15% from 3% and were last seen at 8%, according to data source Defirate.com.

Just like those trading in perpetual contracts, a USDT borrower can hedge risk by executing a buy of floating-for-fixed contracts on Delta.

Delta exchange announced early Thursday that it will soon be launching interest rate swaps for stablecoin USDC and dai. Thus, companies that borrow MakerDAO’s dai and need to pay the volatile stability fee as interest can also hedge. “That stability fee is variable and it exposes the borrower to risk of rising interest rates. IRS will help such companies swap the variable interest rate risk with a fixed risk,” Balani told CoinDesk.

Compound CEO Robert Leshner said that “interest rate swaps will give sophisticated traders an opportunity to more easily access, hedge, and arbitrage floating interest rate markets like Compound – leading to more stable, and less volatile financial products.”

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Source