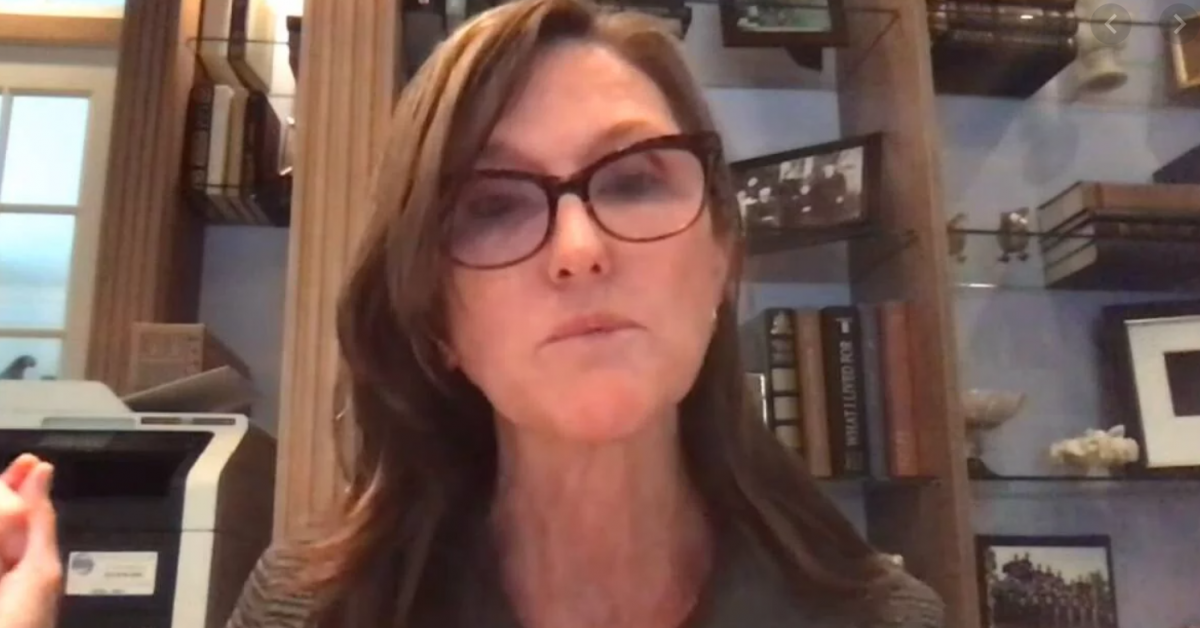

Ark Investment Management CEO Cathie Wood said she doubts U.S. regulators will green-light a bitcoin exchange-traded fund before the original cryptocurrency’s market cap hits $2 trillion.

“The flood of demand has to be satisfied so it’s going to have to get well over a trillion dollars – $2 trillion, I think, before the [U.S Securities and Exchange Commission] will feel comfortable about” a bitcoin ETF, Wood said at Tuesday’s ETF Trends Big Ideas event.

Bitcoin’s market capitalization hovered a tick under $600 billion at press time Tuesday.

Wood was bullish on bitcoin’s prospects under Gary Gensler, the former CFTC commissioner and MIT digital currency professor who has been nominated to lead the SEC by President Joe Biden. Wood called Gensler “very pro bitcoin” and praised the SEC’s crypto savvy leadership.

Gensler, who would undoubtedly become the most crypto knowledgeable SEC chair if confirmed, has nonetheless described himself as “a little bit center minimalist on Bitcoin.” He is more of a “center maximalist” about blockchain technologies and smart contracts, however.

Wood’s Tuesday presentation also featured some bold projections about bitcoin’s price potential should institutional and corporate adoption trends continue. Citing MicroStrategy’s bitcoin-first treasury policy, Wood said that if every S&P 500 company invested 1% of their assets in bitcoin the price would increase by $40,000.

“Institutional allocations between 2.5% and 6.5% could impact bitcoin’s price by $200,000 to $500,000,” read one slide deck.

Source