One of the biggest debates taking place on a global scale relates to energy production and the integration of renewable energy sources into an electrical grid dominated by carbon-based fuels and nuclear power.

Energy Web Token (EWT) is one project that is growing in popularity as it aims to integrate blockchain technology into the energy sector. The project also plans to help with application development and it is creating a decentralized energy exchange.

Data from Cointelegraph Markets and TradingView shows that the price of EWT increased 65% from a low of $11.38 on Feb. 28 to a new all-time high of $18.78 on March 3 with a record $8.66 million in 24-hour trading volume.

EWT/USDT 4-hour chart. Source: TradingView

EWT/USDT 4-hour chart. Source: TradingView

The main development helping drive the price of EWT higher was its March 1 listing on Kraken exchange. Kraken is currently the fourth-largest cryptocurrency exchange by volume and has provided EWT with its largest trading market to date.

Trading volume for EWT increased by 265% following its listing on Kraken and today the price continues to move higher as community members speculate on which exchange will list EWT next.

EWT announces staking and utility nodes

Another source of optimism for EWT came from the Feb. 25 announcement that staking would soon be enabled for token holders in the form of escrow-based decentralized service-level agreements (SLA), which will be used to create utility nodes that will offer services on the network with the stake acting as an incentive to provide quality services.

According to Energy Web’s Chief Commercial Officer Jesse Morris, the staking mechanism created for EWT is a “new kind of crypto model.”

Morris said:

“It’s key to unlocking tens of thousands of utility nodes (run by the ecosystem) offering cheap, reliable IT services to grid operators. No more vendor lock-in or RFPs required to standup an enterprise app.”

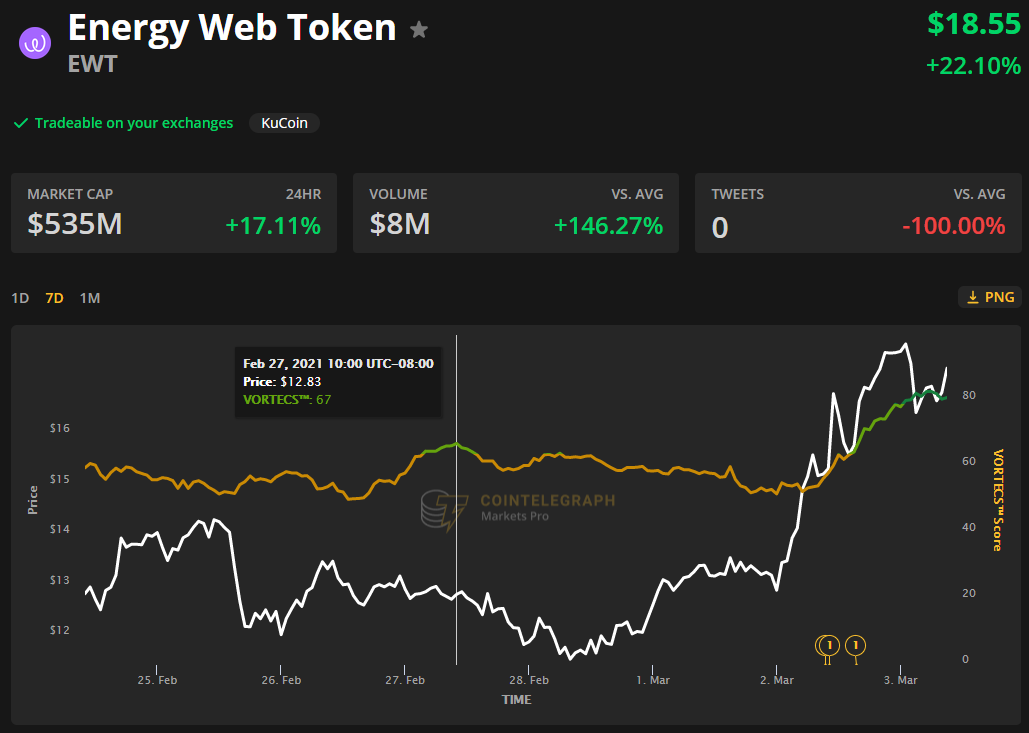

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for EWT on Feb. 27, prior to the recent price rise.

The VORTECS™ score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. EWT price. Source: Cointelegraph Markets Pro

VORTECS™ Score (green) vs. EWT price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ score for EWT reached a high of 67 on Feb. 27, roughly 60 hours before the price began to break out from $12.91 to its current price of $17.91. At the time of writing EWT’s VORTECS™ score stands at 80.

The debate surrounding renewable energy and its integration into the global economy is likely just getting started, and Energy Web Chain could have the first-mover advantage in the decentralization of the energy industry.

Increasing incentives for token holders, along with new exchange listings has EWT well-positioned to become a leader in the blockchain-based energy marketplace and this is bound to draw in new investors.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Source