Since topping out at $18,476 on Nov. 17, Bitcoin price has been flirting with the $18,000 level as bulls fight to flip the level to support and chase after the all-time high at $19,789.

While this battle takes place and the bulk of crypto and mainstream finance outlets focus on Bitcoin price, a number of less-loved crypto assets are producing generous returns for investors.

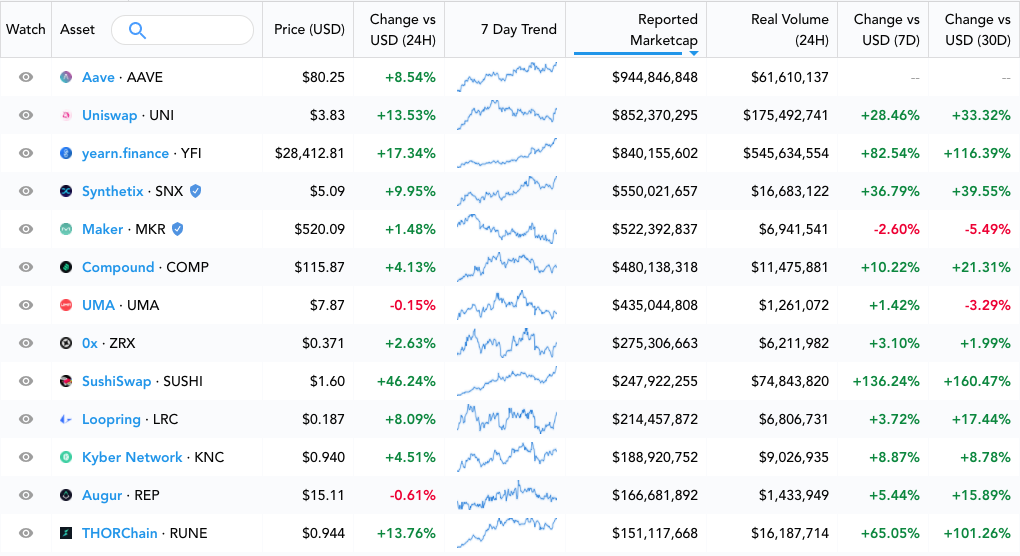

DeFi Assets Index. Source: Messari

DeFi Assets Index. Source: Messari

As shown by Messari’s DeFi assets index, many of the top tokens are providing hefty double-digit gains.

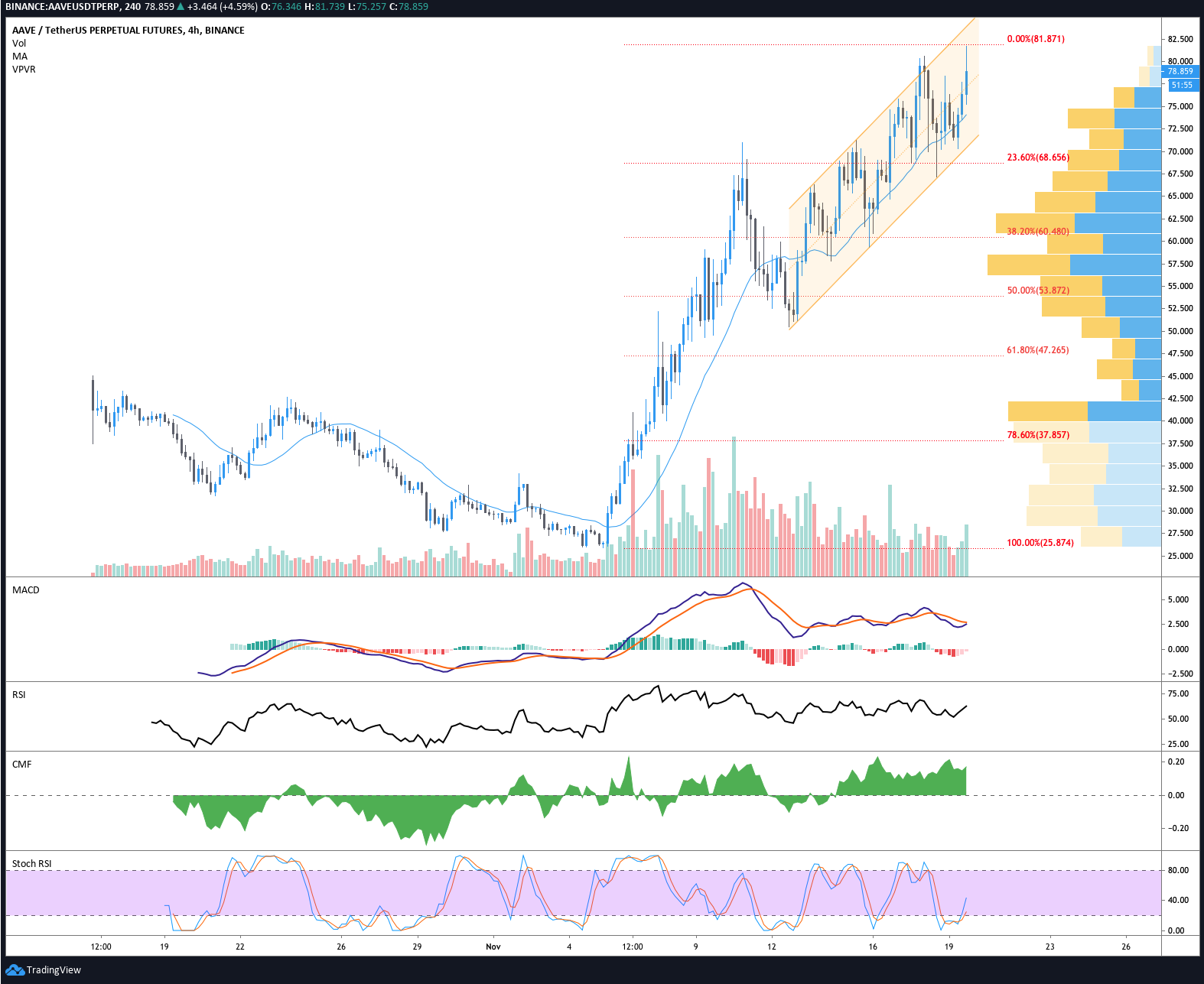

Within the last 7 days, AAVE ricocheted off its double bottom to rally 214% and currently trades slightly above $80.

Day traders are likely playing the support / resistance checks within the ascending channel pattern. At the time of writing, AAVE’s trading volume, MACD and RSI still reflect a healthy amount of interest from bulls.

AAVE/USDT. Source: TradingView

AAVE/USDT. Source: TradingView

Even Curve finance’s CRV governance token, one which many crypto investors have described as a complete laggard, pulled off a clean double bottom reversal and rallied 176% to $0.84.

CRV/USDT. Source: TradingView

CRV/USDT. Source: TradingView

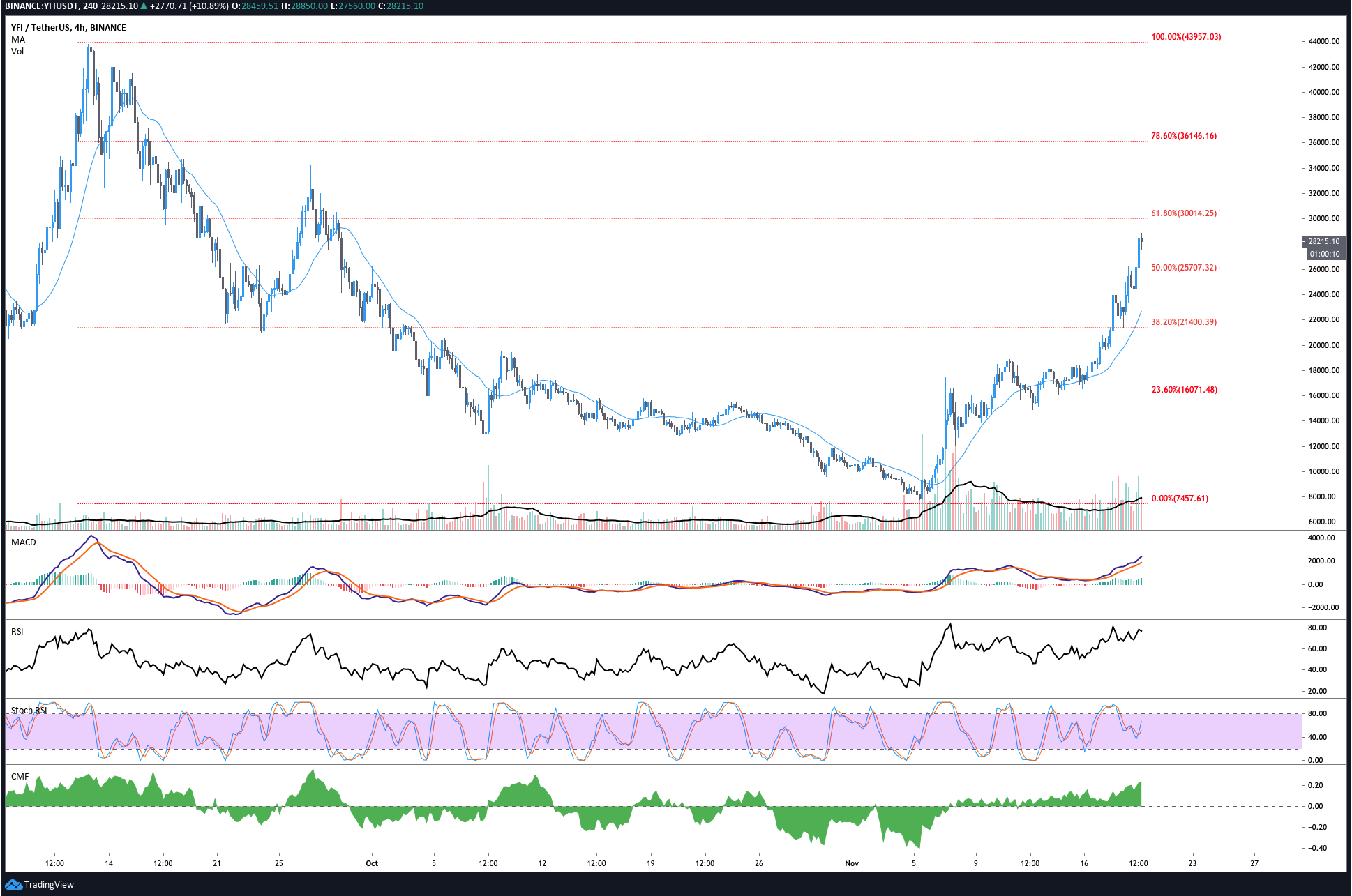

After nearly being shorted to death by the likes of Sam Bankman-Fried and other savvy professional traders, Yearn Finance’s (YFI) token is also making waves with an 83.5% gain in the past week.

YFI/USDT. Source: TradingView

YFI/USDT. Source: TradingView

On Nov. 18 YFI price was at the 50% Fibonacci retracement level ($25,500) and bulls were attempting to flip the level to support. Within the last few hours, this was accomplished and the price sliced through a gap in the volume profile visible range (VPVR) to make a new daily high at $29,850.

Unsuprsingly, YFI clones like DFI. Money (YFII) and YF Link (YFL) also followed suit and each has rallied 58% and 49% respectively.

SushiSwap switches spots with Uniswap

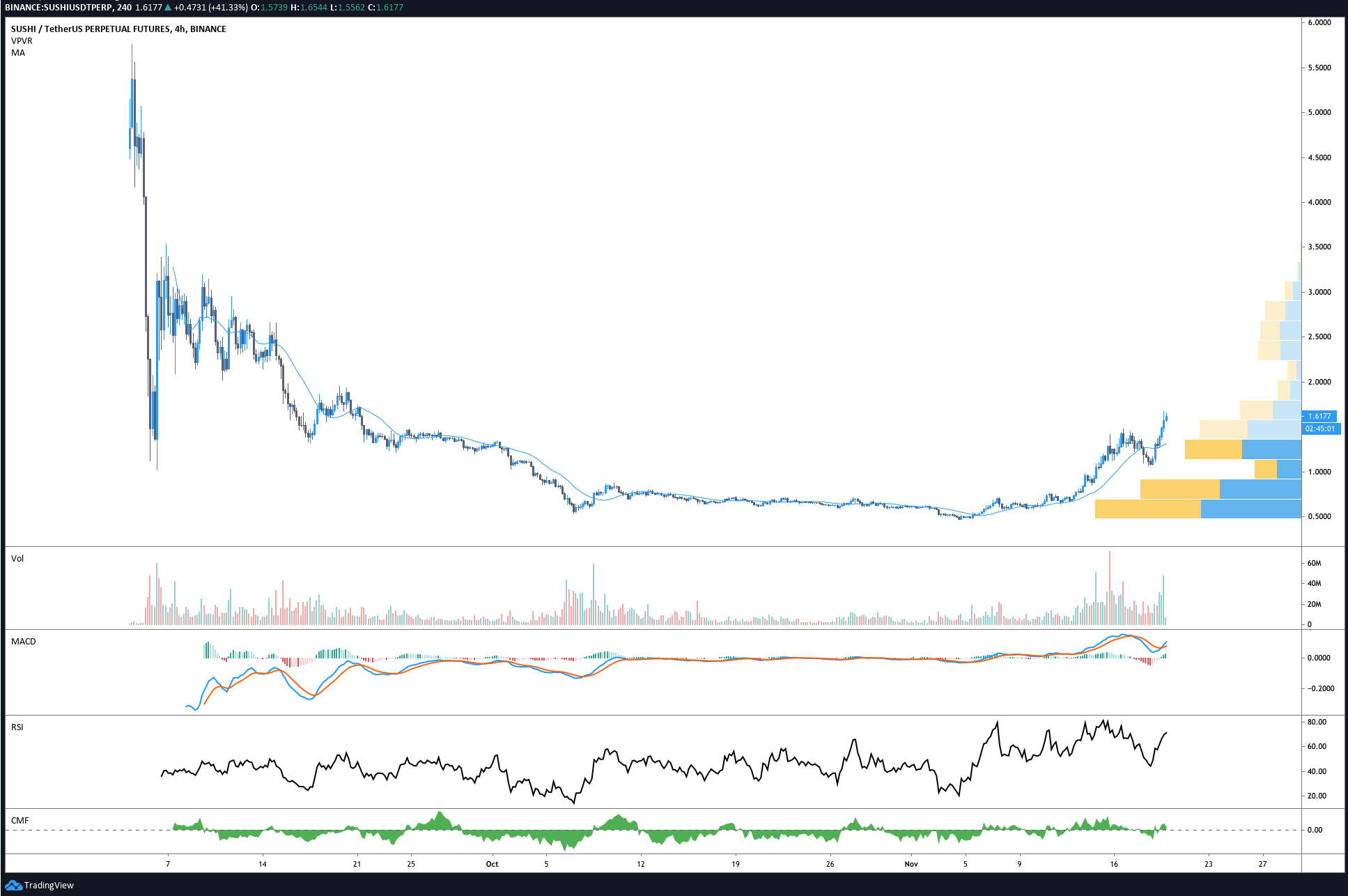

SushiSwap’s (SUSHI) governance token has also attracted the attention of investors after losing more than 95% of its value back in September when Chef Nomi, the lead developer dumped approximately $13 million worth of SUSHI on the open market.

SUSHI/USDT. Source: TradingView

SUSHI/USDT. Source: TradingView

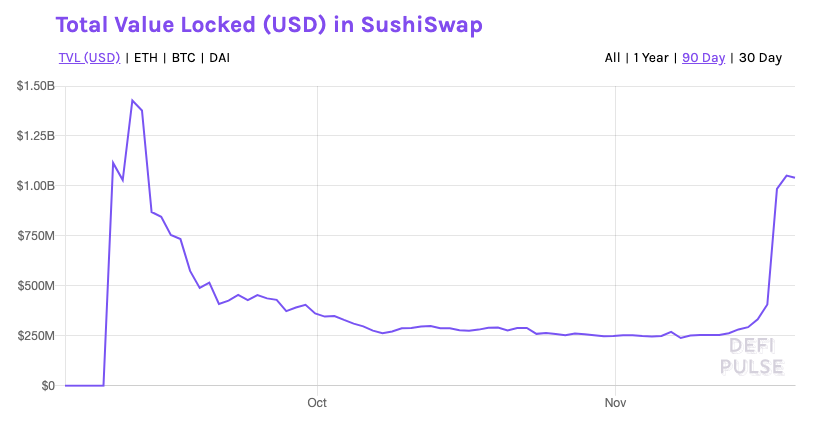

As reported by Cointelegraph, this week marked the end of Uniswap’s liquidity pool rewards and rival exchanges like SushiSwap, 1inch, and Bancor have upped the APY rewards offered on their listed assets to attract former Uniswap liquidity providers.

Total value locked (USD) in SushiSwap. Source: DeFi Pulse

Total value locked (USD) in SushiSwap. Source: DeFi Pulse

In fact, this week Uniswap saw a $1.3 billion dollar (57.5%) drop in in its total value locked as users sought more fertile pastures at other DeFi platforms. As this occurred SushiSwap saw a more than 300% increase and in the past week the token has rallied by 127% to trade at $1.63.

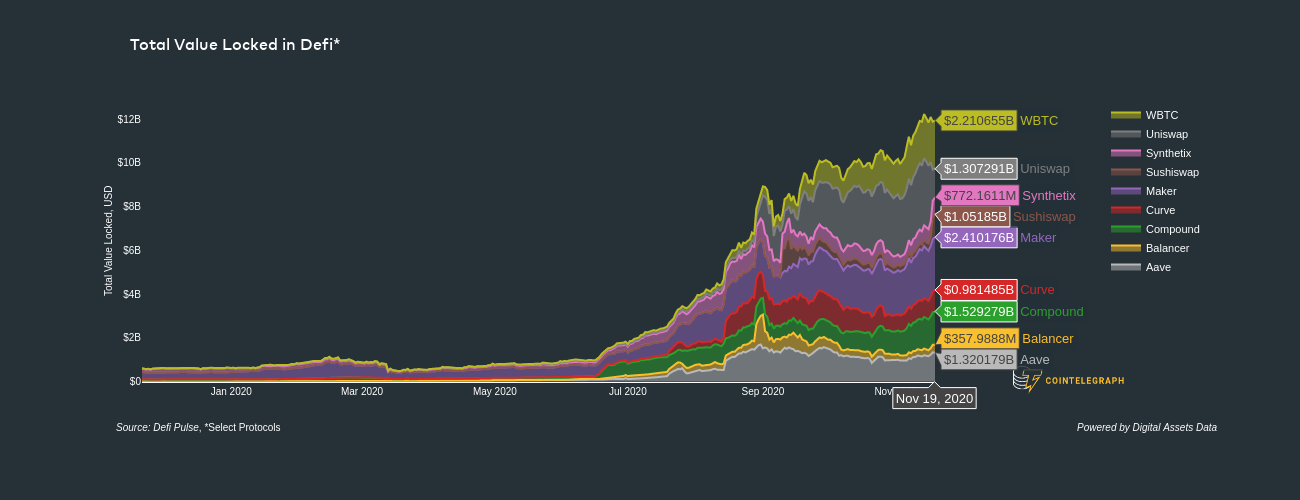

Across the board, the majority of DeFi tokens are currently in the black and data from Digital Assets Data and DeFi Pulse shows an increase in daily active users, TVL across platforms and daily transaction volumes.

Total value locked in DeFi platforms. Source: Digital Assets Data

Total value locked in DeFi platforms. Source: Digital Assets Data

Similar price action can also be seen across many altcoins, suggesting that while Bitcoin consolidates and attempts to flip $18,000 to support, traders have again embraced DeFi and altcoins.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Source