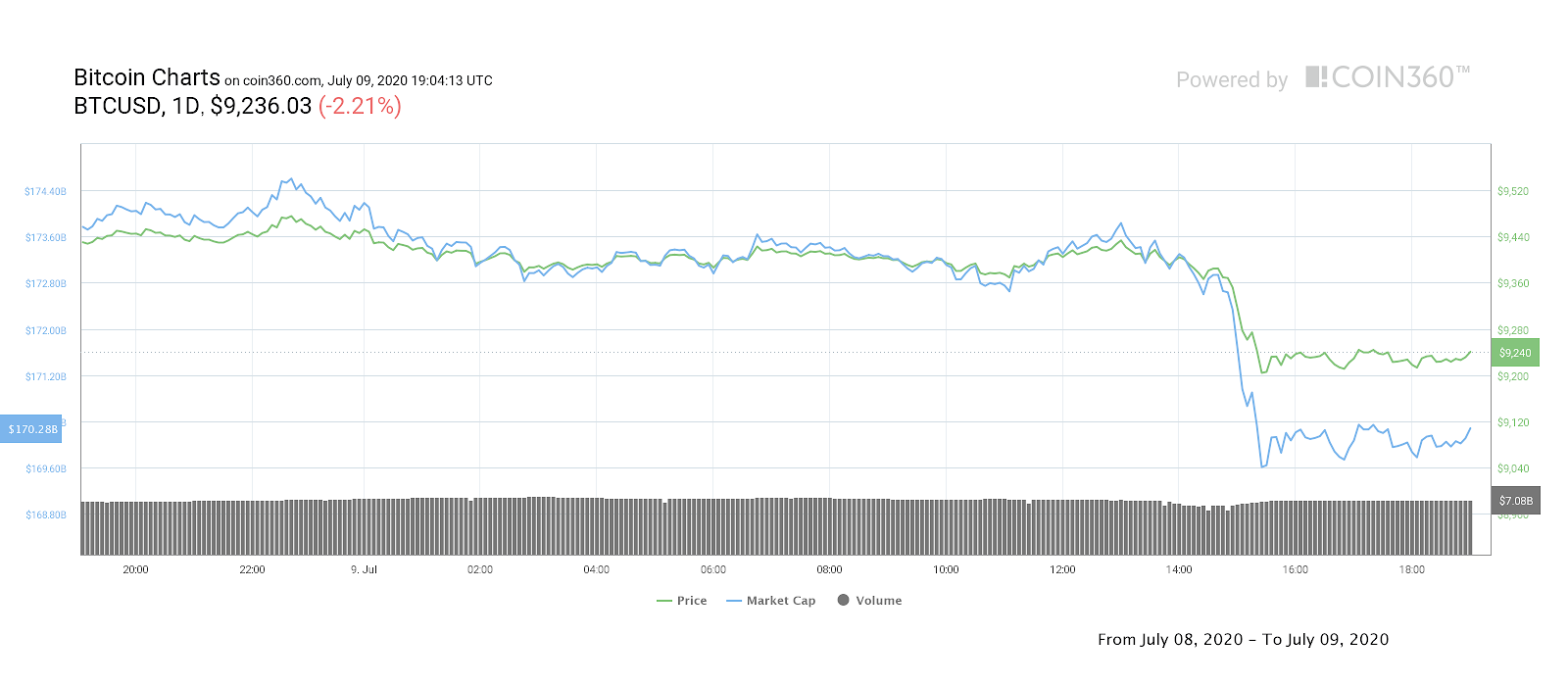

Today Bitcoin (BTC) price abruptly dropped 2.93% to $9,160 before traders stepped in to push the price back to the $9,200 level.

Crypto market weekly price chart. Source: Coin360

The mild correction occurred as the Dow pulled back 370 points and the S&P 500 and Nasdaq also saw small losses. Gold also pulled back 0.92% but still is only $17 away from its recent high at $1,818.

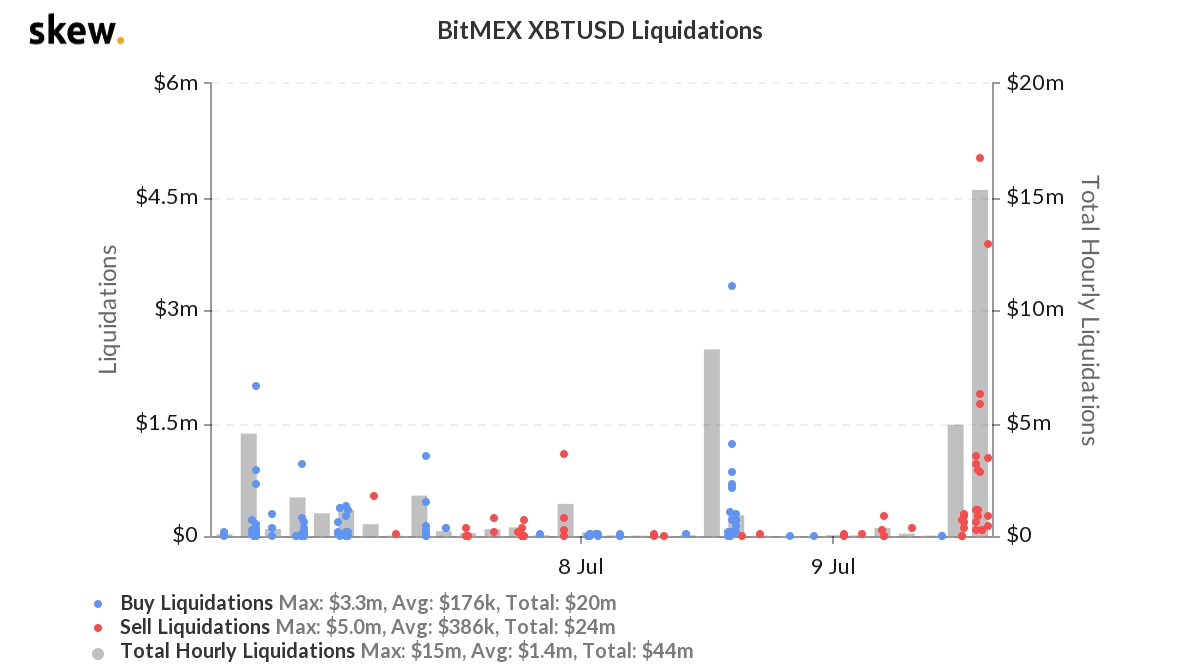

BitMEX XBT-USD Liquidations. Source: Skew

The drop below $9,200 resulted in $15 million in BitMEX liquidations and at the time of writing the price is pinched between the 100-MA and the descending trendline from the local high at $10,376.

BTC USDT 4-hour chart. Source: TradingView

As shown on the 4-hour timeframe, there is a neutral doji candlestick, showing bulls and bears are in contention on the direction Bitcoin price will take.

Also, on the hourly time frame the RSI has dipped into oversold territory and traders will likely look for an oversold bounce shortly.

In such a situation, traders will need to keep an eye on trading volume as the price will need to clear the 20-MA ($9,300) to restore the bullish momentum seen on June 8.

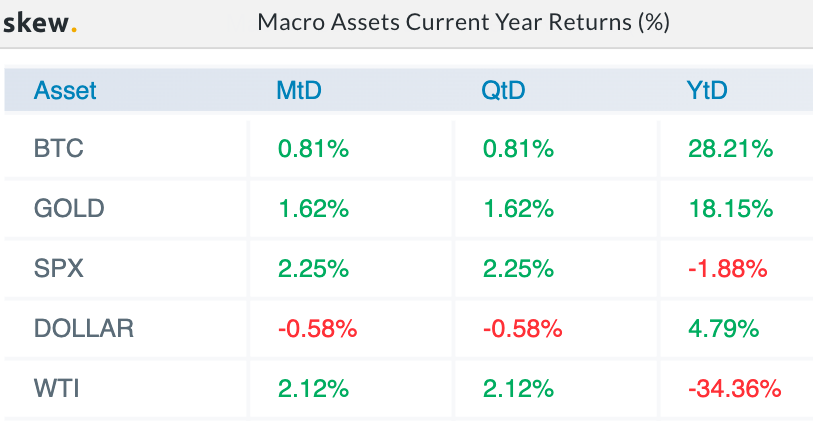

Macro Assets Current Year Returns (%). Source: Skew

Despite the slight blip in Bitcoin’s bullish price action, the digital asset remains the top performing asset year-to-date with a 28.21% return.

Bitcoin daily price chart. Source: Coin360

As Bitcoin price corrected, many altcoins also took a breather after a stellar week which saw many post double-digit gains. Ether (ETH) pulled back 2.37%, Cardano (ADA) dropped by 7.37%, and Chainlink (LINK) lost 4.52%.

According to CoinMarketCap, the overall cryptocurrency market cap now stands at $271.5 billion and Bitcoin’s dominance rate is 62.8%.

Keep track of top crypto markets in real time here

Source