Chainlink may be trading at half of its all-time high, but it just broke a new record – this time for its best single-day performance in all of 2020.

With such an outstanding rebound from local lows making the early days of the rally look weak by comparison, is this a sign that Chainlink is ready to set its sights back on new price records next?

Chainlink Sets Record For Best Intraday Performance In 2020

Chainlink has once again been the best performing crypto asset across the market for the second year in a row. From the Black Thursday low to high, LINKUSD surged by over 1200% before the $20 top proved to be the one level the altcoin couldn’t yet breach.

Related Reading | Mega Bitfinex Bitcoin Whale: Chainlink FOMO Will Eventually Fizzle

However, the seemingly unstoppable rocket ship that is Chainklink, may have only pulled back to refuel its jets. After a fall from the 2020 peak to the recent low of $7.50, representing an over 60% correction, the asset rallied over 30% yesterday.

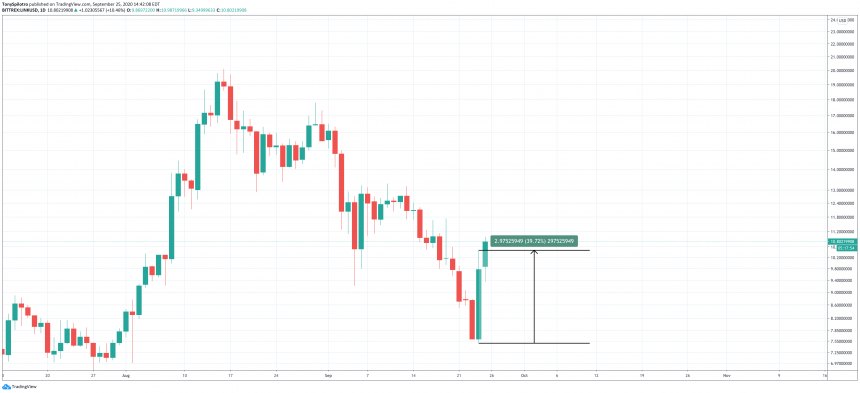

LINKUSD Daily 2020 Intraday Rally Record | Source: TradingView

In 24 hours alone, from the bottom of the daily candle’s wick to the high on the same day, Chainlink rallied well over 39%. In two days, LINKUSD is up 46%, erasing much of the losses from the fall from the top.

Crypto Stand Out Star May Not Be Out Of The Woods, 80% Or More Correction Possible

Chainlink’s powerful recovery is just as strong as the lead up to the asset’s all-time high earlier this year, and then some. However, after falling more than 60% from its peak, the asset in just 38 days reached incredibly oversold conditions.

When any asset becomes that oversold, a strong bounce is possible. When Bitcoin first collapsed from $20,000, it first fell to $6,000, then immediately rebounded back above $11,000 before the bear market began.

Related Reading | Chainlink Correction “Healthy,” But Losing $8 Could Turn Holders Into “Submarines”

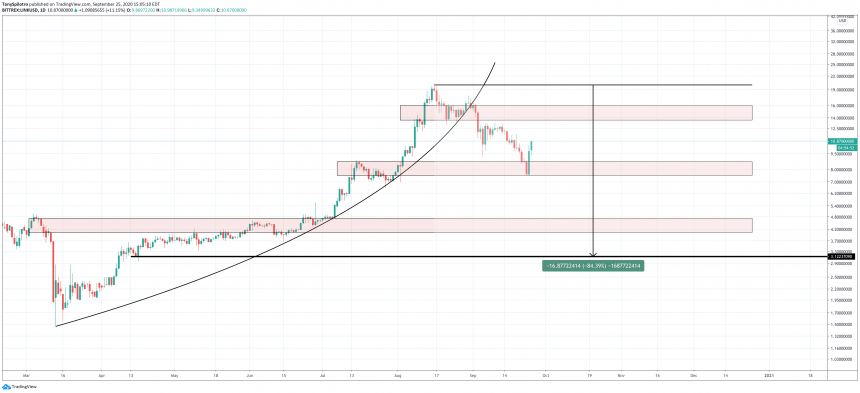

Just because Chainlink’s recovery is impressive, it doesn’t necessarily mean that the asset is will be off to new all-time highs once again. The altcoin’s parabolic advance has been broken, and when that occurs, statistics show that assets regularly fall 80% or more afterward.

LINKUSD Daily 2020 Intraday Rally Record | Source: TradingView

This same occurrence and price target was reached in Bitcoin after it lost $20,000, but it took an entire year for the asset to reach the target. Several dead cat bounces took place all throughout the first phase of the bear market, forming a descending triangle. In total, Bitcoin fell over 84%, depicted in the LINKUSD chart above.

Looking back at Chainlink’s chart, its only retested one major support level. It may retest several more levels deeper in the days ahead. If it does, that doesn’t make the cryptocurrency any less valuable as a long-term hold. However, it may not be worthing chasing the recent gains, and waiting for another retest to buy into the once-unstoppable altcoin.

Featured image from Deposit Photos, Charts from TradingView

Source